How do you feel about the market and economy? Investors’ collective answers to this question form sentiment – a key market driver, in our view. Our research suggests sentiment tends to move cyclically in relation to equities. In Fisher Investments UK’s review, investors benefit from knowing where sentiment sits and how it evolves, as it can help illuminate where we are in the stock market’s cycle.

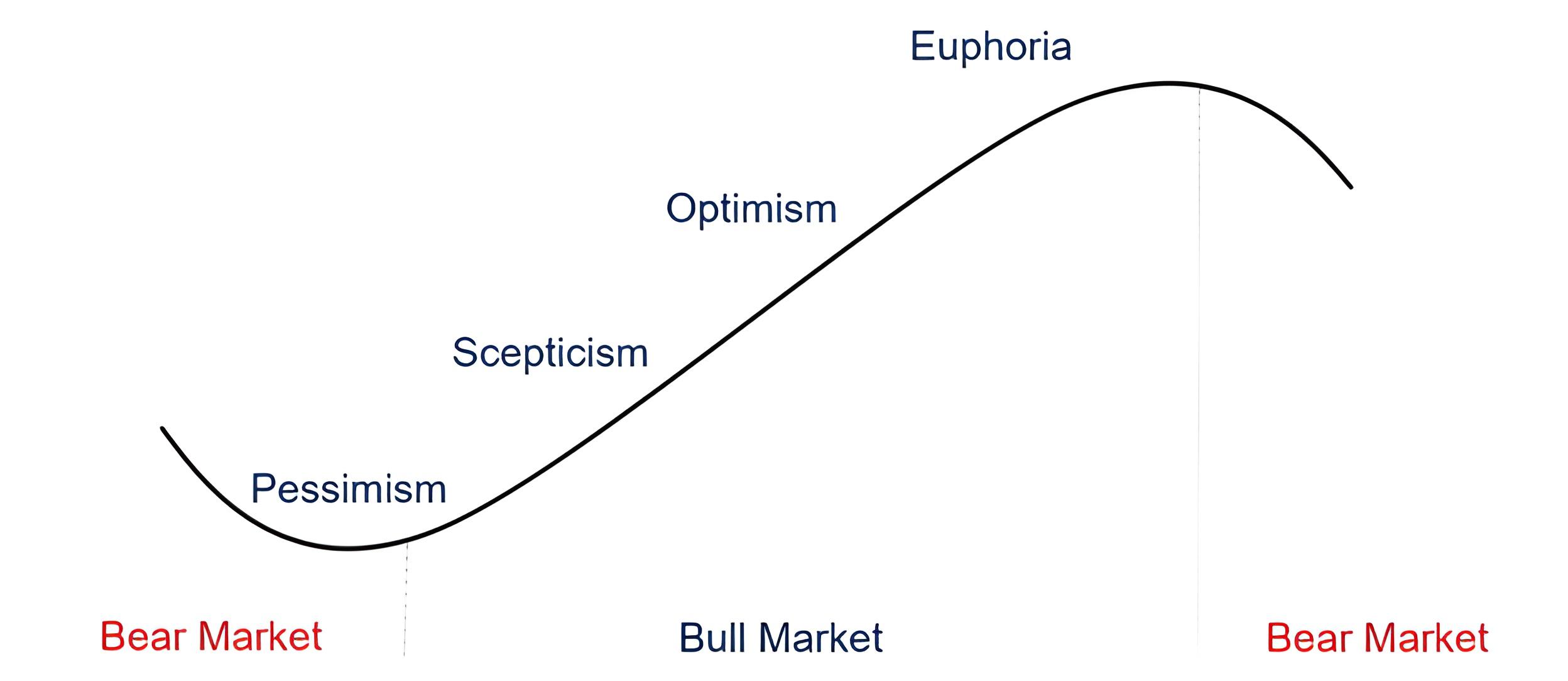

Legendary investor Sir John Templeton once observed that sentiment evolves alongside stock market cycles, forming four stages. He famously stated: “bull markets are born on pessimism, grow on scepticism, mature on optimism and die on euphoria.”[i] Exhibit 1 shows this.

Exhibit 1: The Sentiment Market Cycle

Disclaimer: the illustration above is intended to demonstrate a theoretical point and doesn’t reflect actual returns or market behaviour.

A bull market is a long period of generally rising equity prices. Its opposite is a bear market – a deep, long decline of -20% or worse, typically with an identifiable fundamental cause. The journey from bull to bear is called the market cycle.

Bull markets don’t merely follow bear markets – they generally begin immediately when the bear market ends. This means they start after deep market downturns, often when the economy is performing poorly, according to Fisher Investments UK’s analysis of the economic conditions that have prevailed surrounding past bear market lows. At these stock market lows, which typically follow several months (or sometimes years) of broad market declines, we find investors tend to feel beaten down and overwhelmingly negative about the near future. Yet as time goes on, we see sentiment warms as investors observe equities rising and economic conditions improving. We have observed they become increasingly positive until, eventually, sentiment reaches euphoria – not a rational optimistic assessment of positive conditions, but outlandish enthusiasm that yields expectations reality can’t come close to meeting. Fisher Investments UK’s reviews of market history show equities move on the gap between expectations and reality, so euphoric sentiment can signal a bull market nearing its end due to the low likelihood of reality topping sky-high forecasts.

Fisher Investments UK’s reviews of market history suggest each stage has unique, identifiable signals and symptoms. Consider, first, how pessimism develops. Fisher Investments’ analysis of historical stock market returns (using the S&P 500 in US dollars for its long performance history) finds bear markets tend to start slowly, with gradual declines, before their final panicky stages bring large drops – generating fear and fostering deep pessimism amongst investors who can’t fathom a recovery.[ii] To see this in practice, let us harken back to early 2009, as the stock market was nearing the low of the deep downturn that accompanied the global financial crisis. Then, many commentators we follow were preoccupied with the prospect of financial system collapse. Some headlines we saw posited that the cascade of financial firm failures in autumn 2008 was merely a foretaste. Others profiled individual investors wondering not if a recovery would begin soon, but if the stock market would fall to zero.[iii] But those abysmal forecasts didn’t come true. Instead, equities bottomed in March 2009, birthing a new bull market that rose 41.2% in its first six months alone.[iv] Fisher Investments UK’s research found those big returns arrived not because conditions were suddenly better, but because with such deep pessimism prevalent, positive surprise was easy to achieve even if economic and corporate earnings data weren’t good.

Eventually, we find this deep pessimism morphs to scepticism, where investors broadly see the stock market’s rally but question its staying power. Here, based on Fisher Investments UK’s observations of financial commentary and general behavioural trends, whilst most disaster-type fears have subsided, they have given way to talk of a weaker, slower L-shaped recovery or the next proverbial shoe dropping and potentially undoing some of the market’s progress. One example would be American investors’ preoccupation with local government debt in 2010, when some commentators we followed warned it could rekindle some of the problems that hurt equities in 2007 – 2009 and threaten the nascent recovery. Another would be the prevailing sentiment toward eurozone equities in 2013, over a year into the regional bull market that followed the stock market downturn that accompanied the sovereign debt crisis.[v] At the time, several eurozone member states’ recessions were ending, and sovereign debt yields throughout Southern Europe were down significantly from their crisis-era highs.[vi] Greece’s default in 2012 hadn’t resulted in the euro splintering, and talk of the monetary union’s collapse was fading amongst commentators we follow. But forecasts weren’t bright. Several analysts we follow warned that without structural reforms to address the debt crisis’s legacy, economic growth would be muted. When Cyprus required a bailout early that year, we saw many headlines warning the crisis was far from over. But the eurozone economy returned to growth in Q2 2013, and the bloc’s equities rose 24.4% in 2013.[vii]

As markets continue rising, we observe sentiment shifts to optimism as forecasts turn more positive and good news becomes more widespread. As this happens, Fisher Investments UK sees investor sentiment surveys and financial commentary indicate more individual investors see the rally and want to participate. In this environment, we find people are more eager to bid equities higher, helping markets rise even as the gap between expectations and reality narrows – a concept 20th century economist John Maynard Keynes called animal spirits.[viii] We think the mid-to-late 1990s showed hallmark optimism – amidst solid economic growth globally and positivity around the Internet and technology, investors loaded into equities.[ix] One survey, from the Investment Company Institute, showed the percentage of US households owning equities rose from 19% in 1983 to 48% in 1999.[x] Other measures put participation as high as 53% of American adults by 1999’s end.[xi] Meanwhile, company valuations rose as investors grew increasingly confident in future growth and became willing to pay a higher premium for future earnings.[xii] In Fisher Investments UK’s review, these rising valuations showed markets became less reliant on positive surprise to generate returns, with good cheer and improving sentiment providing more tailwinds.

Eventually, we find sentiment reaches euphoria, where there is little fear and investors en masse project good times forever. Where pessimistic investors can’t fathom the prospect of a recovery at a bear market’s low, euphoric investors typically can’t fathom the prospect of a downturn at a bull market’s high. Importantly, we don’t think euphoria is inherently bearish – Fisher Investments UK’s reviews of market history suggest it can accompany strong returns initially, as we think happened in late 1999 and early 2000. But, in our view, it sets up the next bear market by creating blinders to worsening fundamental drivers. Following our last example, we think investor sentiment tilted into euphoria just before 2000. The turning point, in our view, came in 1999 as initial public offering (IPO) returns spiked along with new listings as investors sought quick riches in the dot-com boom. First-day IPO returns averaged 71.2% in 1999 and 56.3% in 2000, well above their long-term yearly average of 18.9%.[xiii] Hundreds of businesses – many of them low-quality – went public, taking advantage of (and thus displaying) greed-fuelled hot demand as investors dismissed poor fundamentals, like businesses burning through cash on hand whilst racking up big losses. It isn’t that people ignored these issues, but many commentators we followed argued they didn’t matter in an allegedly new era when website visits (known colloquially as clicks) were more important than revenues and profits. But markets hadn’t changed, and losses did matter: Tech equities began falling in US dollars in March 2000, and by September 2000 a global bear market was underway.[xiv]

In Fisher Investments UK’s review, investors benefit from assessing sentiment and where it falls in the market cycle, as it provides perspective amidst outside noise. For example, imagine an investor – knowing sceptical sentiment abounds – reads an article claiming markets are in a late-stage bubble. Rather than panicking, the current sentiment stage serves as a counterpoint – the article may be proof of scepticism. Thus, sceptical sentiment can help reveal a false fear. Alternatively, calls for more pain during rampant pessimism could mean expectations have bottomed, whilst talk of good times forever and the end of boom-and-bust could indicate sentiment overheating. In our view, knowing sentiment’s current stage can help investors stay cool and avoid emotional decisions, whether it be fear or greed.

Interested in planning for your retirement? Get our ongoing insights, starting with The 15-Minute Retirement Plan.

Follow the latest market news and updates from Fisher Investments UK:

This document constitutes the general views of Fisher Investments UK and should not be regarded as personalised investment or tax advice or a reflection of client performance. No assurances are made that Fisher Investments UK will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. Nothing herein is intended to be a recommendation or forecast of market conditions. Rather, it is intended to illustrate a point. Current and future markets may differ significantly from those illustrated here. In addition, no assurances are made regarding the accuracy of any assumptions made in any illustrations herein. Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited has its registered office at: Level 18, One Canada Square, Canary Wharf, London, E14 5AX, United Kingdom. Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission.

Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission. Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.

[i] “Bull Markets Are Born on Pessimism, Grow on Skepticism, Mature on Optimism, and Die on Euphoria,” Barry Popik, The Big Apple, 15/12/2010. A bull market is a long period of generally rising equity prices.

[ii] Source: FactSet, as of 15/4/2024. Statement based on S&P 500 price returns in US dollars. Currency fluctuations between the dollar and the pound may result in higher or lower investment returns.

[iii] “How Low Can the Stock Market Fall?” John W. Schoen, NBC News, 26/10/2008.

[iv] See note ii.

[v] Source: FactSet, as of 9/4/2024. Statement based on MSCI EMU index returns with net dividends in euros, 31/12/2010 – 31/12/2014. Currency fluctuations between the euro and the pound may result in higher or lower investment returns.

[vi] Ibid. Statement based on government debt yields in Greece, Spain, Italy and France, 31/12/2010 – 31/12/2013. Recession dating based on criteria from Euro Area Business Cycle Network (EABCN). A recession is a prolonged decline in economic output.

[vii] Ibid. Eurozone quarterly GDP growth and MSCI EMU index returns with net dividends in euros, 31/12/2012 – 31/12/2013. Currency fluctuations between the euro and the pound may result in higher or lower investment returns.

[viii] The General Theory of Employment, Interest, and Money, John Maynard Keynes, Palgrave Macmillan, 1936.

[ix] Source: FactSet, as of 9/4/2024. Statement based on quarterly GDP growth in the US, UK and other major developed economies, Q1 1994 – Q4 1999.

[x] “Capitalism for the Multitude,” Robert J. Samuelson, Newsweek, 14/11/1999.

[xi] “Capital and Community: Findings From the American Investment Craze of the 1990s,” Brooke Harrington, Economic Sociology, Vol. 8, Iss. 3, pp 19 – 25. 2007. Accessed via EconStor.

[xii] Ibid. Statement based on S&P 500 Index price-to-earnings ratio, 31/12/1994 – 31/12/1999.

[xiii] “Initial Public Offerings: Updated Statistics,” Jay R. Ritter, Warrington College of Business, University of Florida, 20/6/2022. Long-term average reflects returns from 1980 – 2021. Returns presented in USD. Currency fluctuations between the dollar and the pound may result in higher or lower investment returns.

[xiv] Source: FactSet, as of 9/4/2024. Statement based on MSCI World index returns with net dividends in euros, 31/12/1998 – 31/12/2001. Currency fluctuations between the euro and the pound may result in higher or lower investment returns.