Despite clean energy hype the last few years, the industry’s equities haven’t fared well.[i] The reason, in Fisher Investments UK’s review: clean energy profits didn’t live up to their initial promise – hype didn’t match reality. We think this shows the importance of looking beyond popular headlines for actionable investment themes.

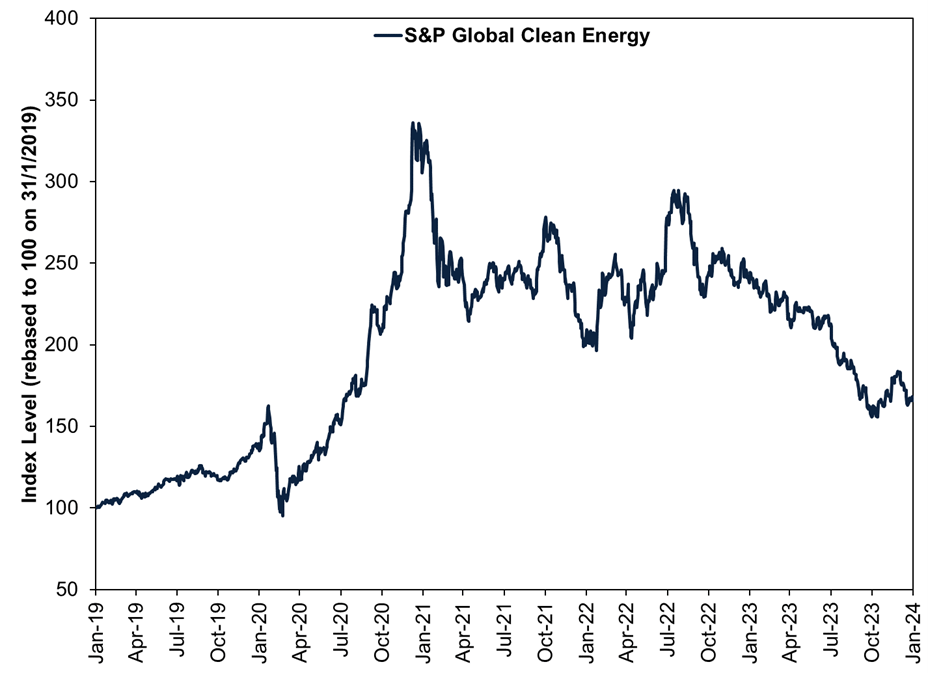

Exhibit 1 illustrates how clean energy equities soared in the lead up to – and first few months after – US President Joe Biden’s 2020 election. This came as commentators we followed touted prospects for a Green New Deal – allegedly spurring massive US infrastructure investments for a wholesale energy transition away from fossil fuels – and the EU’s launch of several initiatives targeting net zero greenhouse gas emissions.

Exhibit 1: Clean Isn’t Always So Green

Source: FactSet, as of 5/2/2024. S&P Global Clean Energy returns with net dividends, 31/1/2019 – 31/1/2024.

We saw many commentators employ the theory that government backing – and generous subsidies – would propel an economic shift as transformative as the Industrial Revolution. Articles Fisher Investments UK reviews suggested declining solar, wind and battery costs were becoming competitive with carbon-based fuels, which clean energy would soon supplant. As Exhibit 1 shows, for a while in mid-2020, equities briefly reflected this rush of optimism. But after that burst, clean energy equities declined precipitously over the last three years.

Why the disappointing returns? Whilst we have nothing against clean energy, our research shows markets move most on the gap between reality and expectations. From that perspective, Fisher Investments UK thinks clean energy expectations rose too high. Although it can be cheaper than fossil fuels at times, electricity generation from wind and solar remains intermittent – and utility-scale energy storage systems (e.g., batteries, pumped-storage hydroelectric or other means) ensuring grid reliability have yet to mature, adding to costs.[ii] Hence, many clean energy projects require subsidies to build – and remain operational.[iii] But this makes their economics dependent on political backing – often uncertain, in Fisher Investments UK’s experience.

The Biden administration’s Build Back Better Plan proposed sweeping clean energy incentives when it was introduced in 2020. But it was later broken apart, many parts were scrapped and others watered down substantially.[iv] The part that became 2021’s Infrastructure Investment and Jobs Act was less than a third of the original $2 trillion proposal – and its roughly $550 billion in new spending trickles out over five years.[v] Money not yet spent is subject to cancellation by later Congresses. Funding isn’t guaranteed.

Or take the UK government’s efforts to develop offshore wind capacity. In September, it held an auction to award contracts for generating 5 gigawatts of electricity from offshore windfarms over 15 years at 44 pounds per megawatt-hour.[vi] But there were no bidders, as prospective windfarm builders/operators cited too-low pricing to make it worth their while.[vii] Although the government has since upped its pricing to 73 pounds per megawatt-hour and will reopen the auction in March, we think wind power’s escalating costs speak to the challenges the clean energy industry faces.[viii]

Back in the US, for another example, the world’s largest offshore windfarm developer announced a $4 billion writedown on cancelled projects off the East Coast last November because of supply chain delays and higher interest rates.[ix] To the extent private firms fund these projects, many of them tend to be very credit-sensitive, in Fisher Investments UK’s review. Thus, we find they had a bad combination over the last few years: fast-rising interest rates and excessive hype over clean energy’s prospects.

Now, this doesn’t mean clean energy won’t work out long term. It is possible the global economy decarbonises completely by 2050. Technological advances may make clean energy more financially stable, too. But equities look only 3 – 30 months ahead according to our research. In that span, we doubt the energy transition will be fully realised.

Besides uncertain government pricing and cost overruns, obtaining the necessary permits can take years – especially when it is through multiple agencies and jurisdictions. Typically, Fisher Investments UK’s reviews find the larger (and more impactful) the project, the longer it will take. And that isn’t even taking into account local – and vocal – opposition that can add years of further court challenges, environmental reviews and the like, in our experience. Many solar and wind projects have recently run into not-in-my-backyard sentiment, forcing planners to scupper them.[x] Furthermore, the amounts of copper and other metals needed for electrification is so large-scale that it will require many years of mining to meet.[xi]

Perhaps even more fundamentally: governments’ clean energy plans aren’t secret – we see them making headlines regularly with their potential impacts discussed thoroughly. And according to our analysis, markets price widely known information almost instantaneously. Such common knowledge doesn’t confer any advantage. To us, investing based on trending front-page features amounts to following the herd. Based on Fisher Investments UK’s reviews of how to beat the crowd, ask yourself: what do you know that others don’t about factors likely to develop in the next 3 – 30 months?

Interested in planning for your retirement? Get our ongoing insights, starting with a copy of Your Net Worth.

Follow the latest market news and updates from Fisher Investments UK:

This document constitutes the general views of Fisher Investments UK and should not be regarded as personalised investment or tax advice or a reflection of client performance. No assurances are made that Fisher Investments UK will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. Nothing herein is intended to be a recommendation or forecast of market conditions. Rather, it is intended to illustrate a point. Current and future markets may differ significantly from those illustrated here. In addition, no assurances are made regarding the accuracy of any assumptions made in any illustrations herein. Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited has its registered office at: Level 18, One Canada Square, Canary Wharf, London, E14 5AX, United Kingdom. Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission.

Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission. Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.

[i] Source: FactSet, as of 14/2/2024. Statement based on S&P Global Clean Energy Index returns, 31/12/2020 – 31/12/2023.

[ii] “Energy Storage for Electricity Generation,” Staff, US Energy Information Administration, 28/8/2023.

[iii] “Federal Financial Interventions and Subsidies in Energy in Fiscal Years 2016–2022,” Staff, US Energy Information Administration, 1/8/2023.

[iv] “Build Back Better Act,” Staff, Ballotpedia, accessed 5/2/2024.

[v] “Infrastructure Investment and Jobs Act of 2021,” Staff, Ballotpedia, accessed 5/2/2024.

[vi] “‘Biggest Clean Energy Disaster in Years’: UK Auction Secures No Offshore Windfarms,” Jillian Ambrose, The Guardian, 8/9/2023.

[vii] Ibid.

[viii] “UK to Offer Wind Developers Significantly Higher Electricity Prices,” Irina Slav, OilPrice.com, 16/11/2023.

[ix] “Orsted Cancels Two New Jersey Offshore Wind Projects, Takes $4 Billion Writedown,” Catherine Clifford, CNBC, 1/11/2023.

[x] “US Counties Are Blocking the Future of Renewable Energy: These Maps, Graphics Show How,” Elizabeth Weise, Stephen J. Beard, Suhail Bhat, Ramon Padilla, Carlie Procell and Karina Zaiets, USA Today, 4/2/2024.

[xi] “Copper Is Critical to Energy Transition. The World Is Falling Way Behind on Producing Enough,” Bob Woods, CNBC, 27/9/2023.