First, GDP and equities represent different things. Many commentators we follow treat GDP as the sum-total of the economy – i.e., growing GDP reflects a growing economy and therefore should also reflect the equity market.[i] In Fisher Investments UK’s review, reality is more nuanced. Some GDP components do reflect private-sector demand, which our research finds equities care about most. But GDP also tallies government spending, which we don’t think is necessarily productive as we find it mostly just shifts economic activity around rather than expanding the economy as a whole.[ii] Additionally, GDP subtracts imports from exports in an effort to tabulate single-country output. But this omits the fact many businesses sell or use imports in their end products.

Meanwhile, our research shows equities – which give owners a corresponding share of publicly traded companies’ earnings – look mostly at corporate profitability. GDP encompasses different things than what equities are primarily concerned about, in Fisher Investments UK’s review, whilst leaving out other factors influencing them. We find economic growth drives equities, but only as it affects publicly traded companies’ earnings. GDP doesn’t account for this precisely, based on our analysis. For example, there are many more privately held companies – whose output GDP tabulates – that aren’t listed on public exchanges than are.[iii]

Now, upon cursory review, equities and GDP may seem to trend higher over the long term, whilst having ups and downs together along the way. We think this is broadly because human creativity – channelled through markets – grows economies and generates wealth, benefitting equities. But Fisher Investments UK’s reviews of their relationship indicate a more complicated dynamic. Namely – and most importantly – in our view, equity prices are forward looking, anticipating companies’ future profitability, whilst GDP reflects only what happened, making it backward looking. In practise, we find this means equities move ahead of the economy. We have observed markets typically peak before economic contractions and trough before they end.

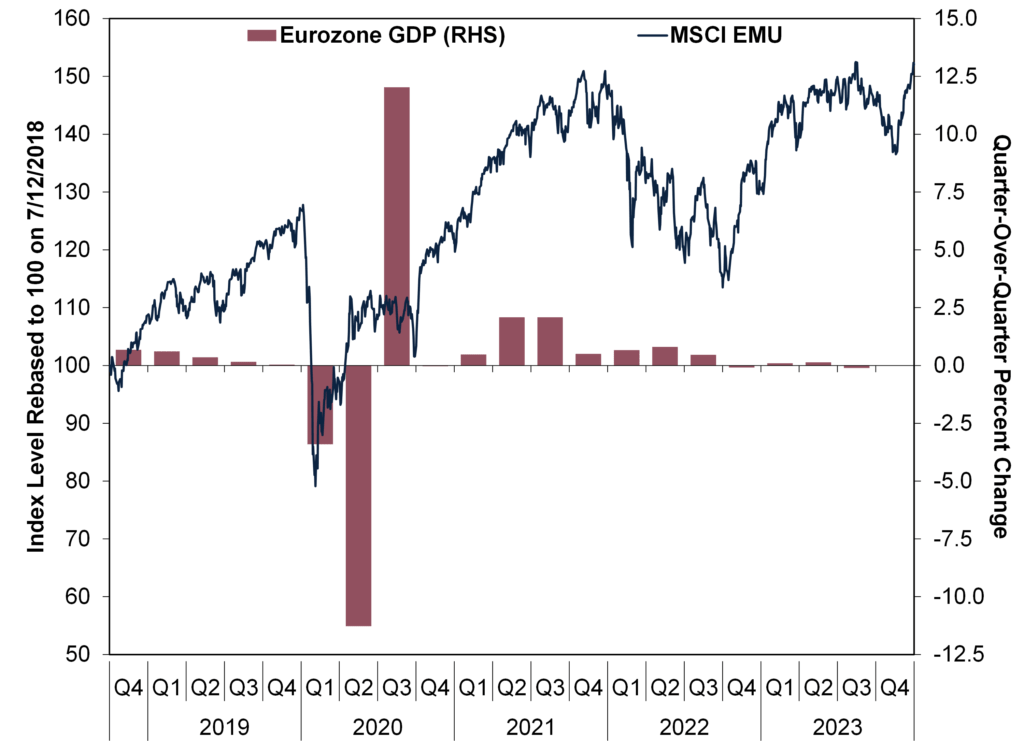

Exhibit 1 shows this in 2020 and 2022, when eurozone equities fell before economic releases indicated GDP downturns and rose before reports signalled recoveries. In an extreme instance, eurozone equities peaked on 19 February 2020 and troughed 18 March, several weeks before 30 April’s initial Q1 2020 GDP estimate flashed contraction.[iv] To us, equities rapidly registered COVID lockdowns’ likely near-term impact and a wider range of potential longer-term scenarios. Then, when it became clearer reality would probably avoid the worst possible outcomes – reducing uncertainty – Fisher Investments UK thinks equities began to rebound and continued doing so even through Q2 2020’s subsequent GDP plunge. In our view, equities had priced it in already and were looking ahead – correctly, in hindsight – to Q3’s GDP recovery.

Exhibit 1: Eurozone Equities Moved Ahead of GDP

Source: FactSet, as of 8/12/2023. MSCI EMU returns with net dividends, 7/12/2018 – 7/12/2023, and eurozone GDP, Q4 2018 – Q3 2023. Presented in euros. Currency fluctuations between the euro and the pound may result in higher or lower investment returns.

More recently, Fisher Investments UK thinks eurozone equities began anticipating late-2022 GDP weakness as early as late 2021 – as they fell amidst escalating supply-chain disruptions, rising energy prices and reports of Russian troops along the Ukraine border. Equities dropped further in the wake of Russia’s late-February 2022 invasion as alarm mounted over the war’s impact – and ECB rate hikes attempting to rein in soaring inflation – even as eurozone GDP rose in 2022’s first three quarters.[v]

But eurozone equities troughed on 29 September 2022, months before the bloc’s Q4 2022 GDP was revised down to a marginal contraction in March 2023 (after preliminary estimates for a slight increase).[vi] Even with growth essentially flatlining since (through Q3 2023, as we write in late Q4), equities have risen. To our thinking, they pre-priced a potentially deep recession – prolonged economic contraction – throughout 2022, which has yet to materialise. Fisher Investments UK finds this better-than-expected outcome drove eurozone equities higher in 2023.[vii]

These examples underscore how markets work and bring us to the main takeaway for investors: time and again around the world, we see similar situations that show equities look around 3 to 30 months ahead, continually comparing current earnings expectations against evolving future factors likely to change them. In our view, the gap between the outlook markets already reflect and the resulting reality is equities’ fundamental driver. We find GDP to be a useful scorecard that confirms what markets saw. But it isn’t a perfect reflection, in our view, and equities and GDP needn’t move in lockstep. That is why equities lead and GDP lags in Fisher Investments UK’s reviews of financial market and economic history.

Interested in planning for your retirement? Get our ongoing insights, starting with a copy of Your Net Worth.

Follow the latest market news and updates from Fisher Investments UK:

This document constitutes the general views of Fisher Investments UK and should not be regarded as personalised investment or tax advice or a reflection of client performance. No assurances are made that Fisher Investments UK will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. Nothing herein is intended to be a recommendation or forecast of market conditions. Rather, it is intended to illustrate a point. Current and future markets may differ significantly from those illustrated here. In addition, no assurances are made regarding the accuracy of any assumptions made in any illustrations herein. Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited has its registered office at: Level 18, One Canada Square, Canary Wharf, London, E14 5AX, United Kingdom. Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission.

Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission. Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.

[i] “What Is Economic Growth? And Why Is It So Important?” Max Roser, Our World in Data, 13/5/2021.

[ii] Source: FactSet, as of 8/12/2023. Statement based on eurozone GDP’s “General Government” category.

[iii] “Why Your Favorite Companies Are Privately Held,” Abby Copeland, Business Review at Berkeley, 28/3/2022.

[iv] Source: FactSet, as of 8/12/2023. MSCI EMU returns with net dividends, 7/12/2018 – 7/12/2023, and eurozone GDP, Q4 2018 – Q3 2023. Presented in euros. Currency fluctuations between the euro and the pound may result in higher or lower investment returns.

[v] Ibid.

[vi] Ibid.

[vii] Ibid.