Editors’ note: Fisher Investments UK doesn’t make individual security recommendations; companies referenced herein are merely examples of a broader theme we wish to highlight.

In Fisher Investments UK’s reviews of financial market commentary, we often encounter views emphasising dividends in portfolios as a superior investment strategy. But we find concentrating on dividends isn’t everything it is cracked up to be. Whilst we have nothing against these payments per se, we think investors are better served focussing on their portfolios’ total returns than on dividends alone. Let us explain why.

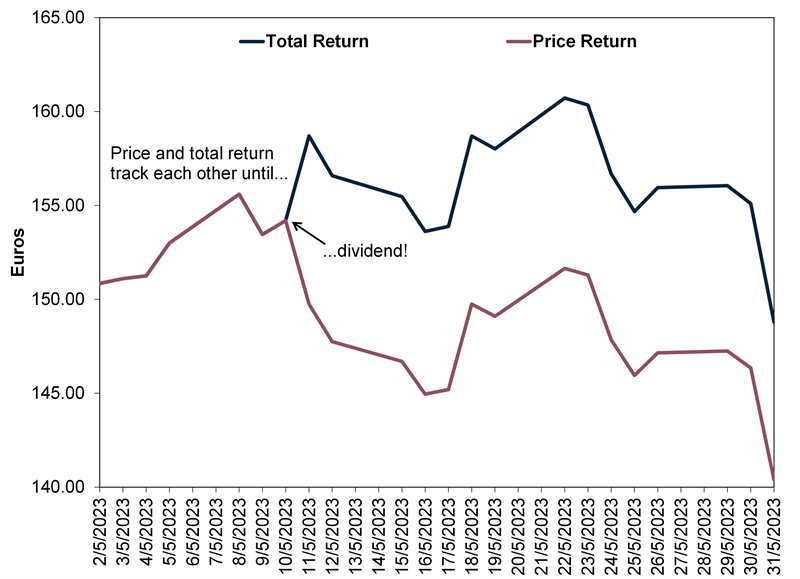

First, it helps to understand what a dividend is and how it works in practise. For shareholders receiving a cash dividend, the amount is subtracted from the share’s price. Daily market swings can make this difficult to see. But when large, the effect can be visible. As Exhibit 1 shows, a dividend is a return of capital, which is paid out of the equity itself. On 10 May 2023, Volkswagen paid a €8.70 dividend to shareholders – and the equity’s price was adjusted down accordingly, subtracting from its total return.

Exhibit 1: Volkswagen AG Shares’ May 2023 Dividend

Source: FactSet, as of 30/9/2023. Volkswagen AG shares, price versus total return in euros, from 2/5/2023 – 31/5/2023. Currency fluctuations between the pound and the euro may result in higher or lower investment returns. Please see our annex for a longer depiction of this data.

Dividends are fine – an investor can pocket or reinvest them – but dividend-payers don’t provide owners with special perks. Consider, too, that dividends aren’t guaranteed – companies can reduce or cut them outright. In Fisher Investments UK’s reviews of financial history, this usually occurs when a company’s earnings are under pressure, often at a time of broader economic or market weakness – which frequently coincides with when investors may need the cash most. This can contrast with the perceived safety that we find many seek when investing in equities for their dividends. But a portfolio’s dividend income isn’t assured to deliver cash flows an investor requires.

Paying dividends also doesn’t mean a company’s equity will be inherently less volatile than equities that don’t pay dividends. For example, dividend-paying equities are common in the Financials sector based on our research.[i] But during 2007 – 2009’s global financial crisis, Fisher Investments UK found dividend payers weren’t immune to high volatility then – ahead of subsequent dividend cuts – and lagged broader markets throughout, as Financials trailed the MSCI World Index by -34.9%.[ii] Ditto for the stretch in Europe during the eurozone debt crisis from 2009 to 2011 when Financials lagged their broader benchmark by -23.6%.[iii]

In Fisher Investments UK’s review, this shows how a dividend focus can lead to undesirable sector concentrations, too. Dividend-paying equities tend to cluster in economically sensitive and value-orientated sectors – the aforementioned Financials, but also Real Estate, Utilities, Consumer Staples, Industrials, Energy and Materials – where earnings are more cyclical (rising and falling with the economic cycle), debt is higher and valuations (like price-to-earnings ratios) are lower.[iv] Because they tend to return more money to shareholders via dividends, we find they typically invest less in growth-orientated endeavours.

Reaching for yield in these areas can skew sector weights, introducing unwanted exposures – and unnecessary risks – in Fisher Investments UK’s review. Take the MSCI World Index’s largest sector by market capitalisation, Information Technology, which has the lowest dividend yield, whilst the sector with the highest dividend yield, Utilities, is the second smallest.[v] Concentrating portfolio weights on the latter at the expense of the former could limit your investment options and impede diversification. Furthermore, considering Utilities are defensive – our research shows they tend to outperform in downturns but not periods of rising equities – emphasising them can negatively impact portfolio results.

We don’t see dividend payers conferring any advantages for those requiring cash flows from their portfolios, either. Consider what we call home-grown dividends – i.e., simply selling equity when you need the cash. In Fisher Investments UK’s experience, many investors don’t consider this option as they focus on portfolio income (e.g., dividends and interest) to generate money from their investments. But selling an equity is functionally the same as earning a dividend – but when you want to (and with potential tax advantages). Dividends aren’t the only way to generate cash, and assuming they are is a needless constraint, in our view.

A more sensible approach, in our view: treat dividend equities as you would any other category of equities. In Fisher Investments UK’s view, it isn’t necessarily beneficial to prioritise dividend income over price returns. We think limiting yourself to just dividend payers limits your portfolio’s capacity to reach your investment objectives. Whilst we have nothing against dividend equities, we also see nothing special about them. Overrating them may distract – and detract – from your portfolio’s overall total return at the end of the day.

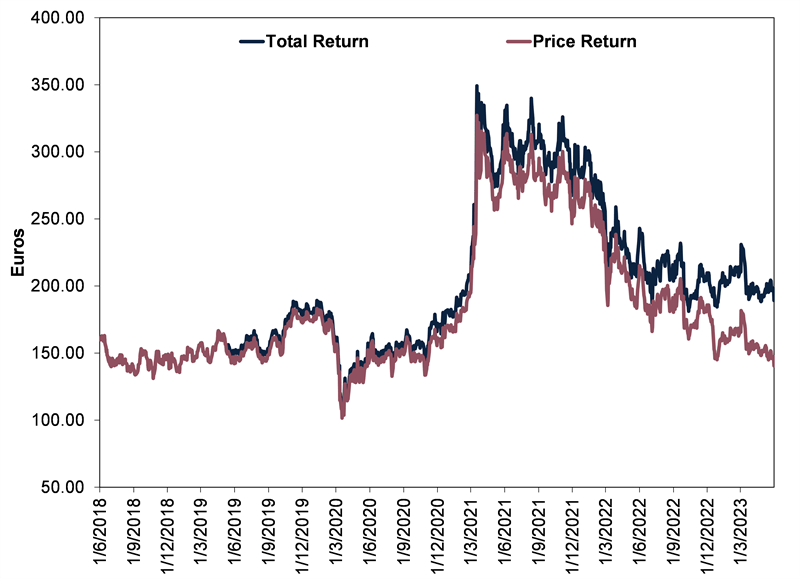

Annex: Volkswagen AG Share Price and Total Return, 31/5/2018 – 31/5/2023

Source: FactSet, as of 30/9/2023. Volkswagen AG shares, price versus total return in euros, from 31/5/2018 – 31/5/2023. Currency fluctuations between the pound and the euro may result in higher or lower investment returns.

Interested in other topics by Fisher Investments UK? Get our ongoing insights, starting with the 15-Minute Retirement Plan.

Follow the latest market news and updates from Fisher Investments UK:

This document constitutes the general views of Fisher Investments UK and should not be regarded as personalised investment or tax advice or a reflection of client performance. No assurances are made that Fisher Investments UK will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. Nothing herein is intended to be a recommendation or forecast of market conditions. Rather, it is intended to illustrate a point. Current and future markets may differ significantly from those illustrated here. In addition, no assurances are made regarding the accuracy of any assumptions made in any illustrations herein. Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited has its registered office at: Level 18, One Canada Square, Canary Wharf, London, E14 5AX, United Kingdom. Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission.

Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission. Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.

[i] Source: FactSet, as of 30/9/2023. Statement based on MSCI World Financials dividend-paying equities.

[ii] Source: FactSet, as of 30/9/2023. Statement based on MSCI World Financials divided by MSCI World Index, 31/12/2006 – 31/12/2009.

[iii] Source: FactSet, as of 30/9/2023. Statement based on MSCI World Financials divided by MSCI World Index, 31/12/2008 – 31/12/2011.

[iv] Source: FactSet, as of 30/9/2023. Statement based on MSCI World Financials, Real Estate, Utilities, Consumer Staples, Industrials, Energy and Materials earnings, debt and price-to-earnings ratios.

[v] Source: FactSet, as of 30/9/2023. Statement based on MSCI World Index sector weights and dividend yields. Market capitalisation is a measure of a company, industry or sector’s size calculated by multiplying share price by the number of outstanding shares.