According to Fisher Investments UK’s research, the amount one invests in each stock market sector has a large influence over how that person’s portfolio will perform relative to the broader market. Accordingly, we think it is beneficial to learn about the various sectors and when they typically are in favour. Here, Fisher Investments UK reviews the Consumer Staples sector.

Consumer Staples includes companies that make and sell everyday products (food manufacturers, grocery stores, pharmacies, etc.). This contrasts with Consumer Discretionary, which focusses on goods that aren’t as necessary like cars, computers and entertainment. The divide between the two may not always be that clean, but Fisher Investments UK thinks it is a helpful guideline.

Looking deeper, Consumer Staples includes six industries.i Beverages and Food Products are the largest, comprising 23.6% and 22.8% of the sector’s market capitalisation, respectively.ii Food & Staples Retailing is third at 20.1%.iii Household Products, Tobacco and Personal Products make up the rest, comprising 15.5%, 9.2% and 9.1%, respectively.iv

With few exceptions, Fisher Investments UK’s reviews of economic history show demand for Consumer Staples’ products stays more consistent than demand for Consumer Discretionary goods, which we find often vacillates with economic activity. To see this, consider how a household might face changing economic conditions. When things are going well, people will often be happy to buy more gadgets, dine out often, take in sports or entertainment and buy that new car. But when recessions (declines in broad economic output) occur, the incentive to reduce spending can be powerful. Even if still employed with constant income, people’s fear of job loss – and seeing companies cutback – can spur changes. When setting lower budgets, the amount allocated for food, soap and other essentials likely stays fairly constant. But vacations, entertainment and new cars? Those aren’t essential and are therefore easy to trim.

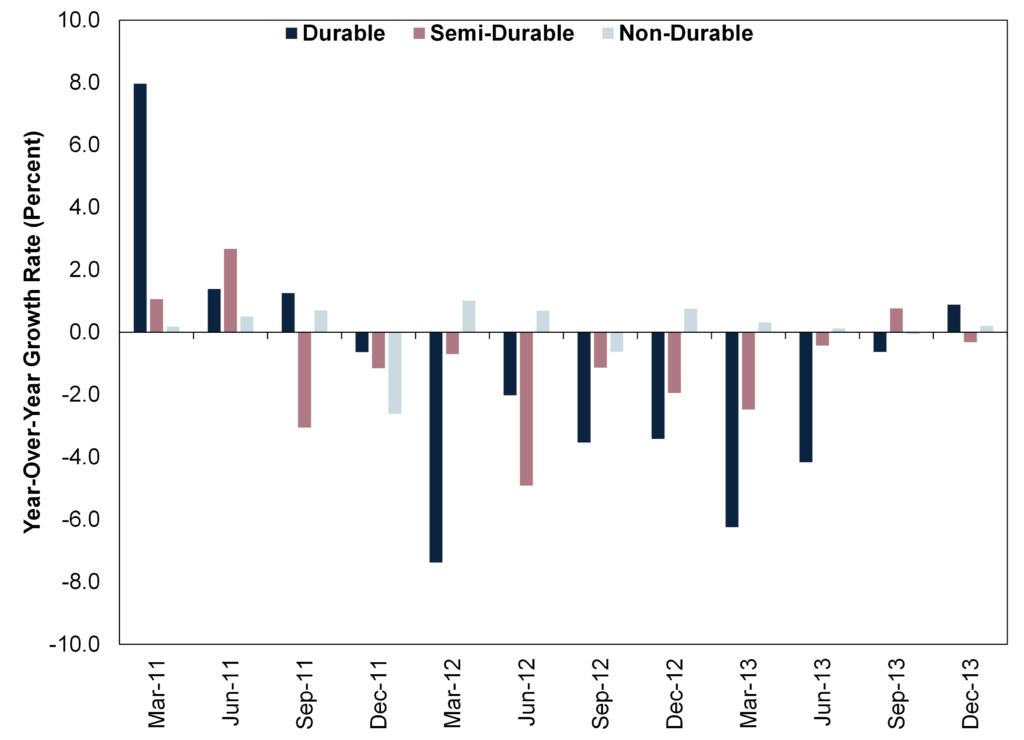

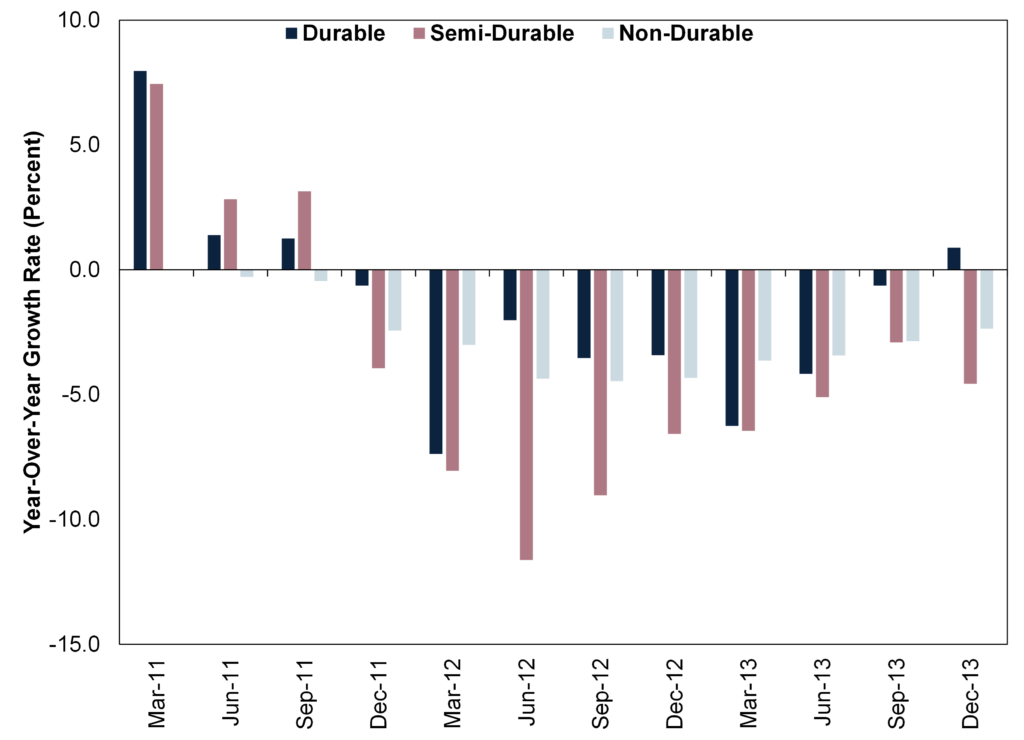

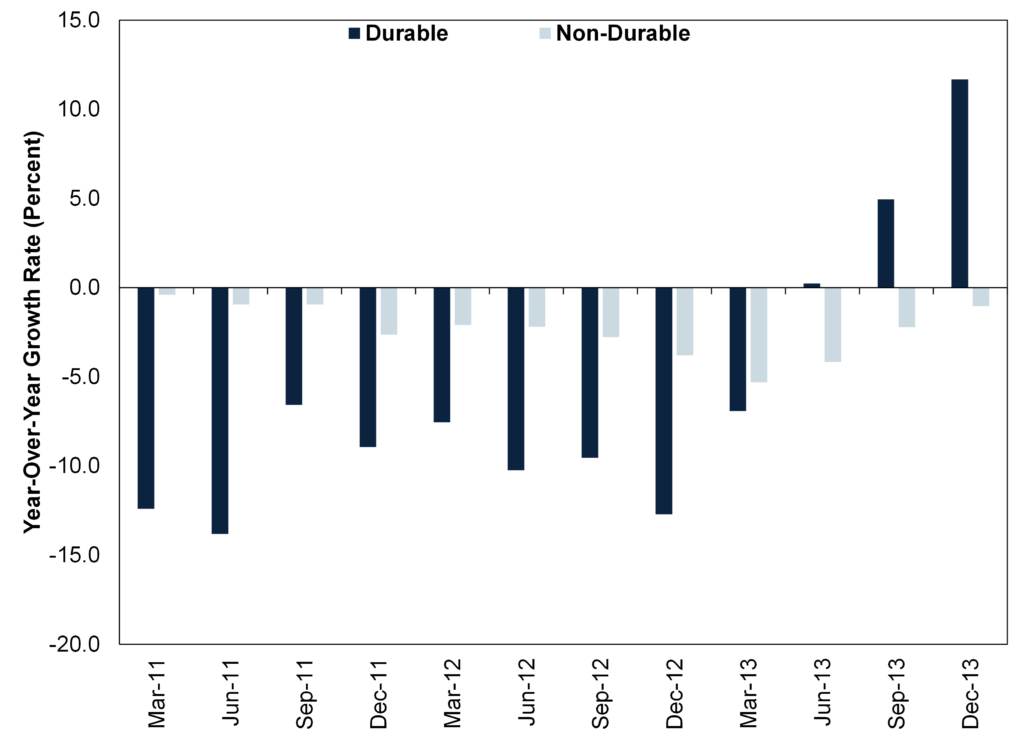

Fisher Investments UK thinks recent data support this. Most eurozone nations report quarterly consumer spending on services and goods, with the latter broken into three categories: durable (goods designed to last more than three years), semi-durable (designed to last at least a year) and non-durable (designed to last less than a year). Many staples will fall into the latter category, whilst many discretionary items – including clothes, autos and electronics – will generally be semi-durable or durable. During the recession that accompanied the eurozone’s debt crisis in 2011 – 2013, as Exhibits 1 – 3 show, non-durable goods spending fluctuated much less than durable and semi-durable goods spending in France, Italy and Spain. It didn’t grow nonstop during the tough times, but its declines were overall milder.

Exhibit 1: France Goods Spending

Source: FactSet, as of 19/1/2023.

Exhibit 2: Italy Goods Spending

Source: FactSet, as of 19/1/2023.

Exhibit 3: Spain Goods Spending

Source: FactSet, as of 19/1/2023. Spending on semi-durable goods excluded due to data availability.

In Fisher Investments UK’s view, this has implications for stocks. When reviewing market and economic history, Fisher Investments UK finds stock market cycles typically change as changes in the economic cycle become likely. Per our research, a bear market (typically a deep decline of -20% or worse with a fundamental cause) is often tied to a recession – and starts before it becomes apparent. Similarly, we find bull markets (long periods of generally rising stock prices) typically pair with growing economies.

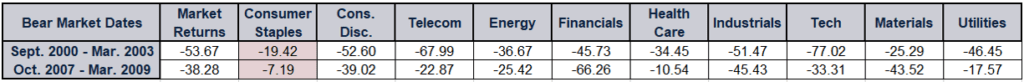

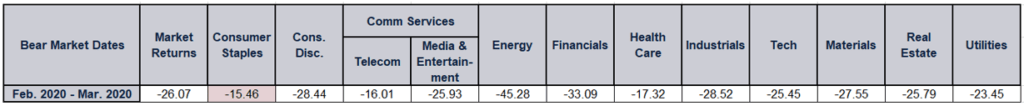

We think this explains why Consumer Staples tends to outperform broader stock market indexes during bear markets. As markets price in the growing likelihood of a recession, we think they also discount the strong likelihood that Consumer Staples’ earnings will hold up better than others. That doesn’t mean the sector rises, but it typically declines less, as Exhibits 4 and 5 depict. This is why many investors, including Fisher Investments UK, consider it a defensive sector with Utilities and the Telecom industry within Communication Services (which was its own sector until 2018).

Exhibit 4: Consumer Staples’ Relative Returns During Recent Bear Markets

Source: FactSet, as of 18/1/2023. MSCI World Index and sector returns with net dividends in pounds, 18/9/2000 – 12/3/2003 and 12/10/2007 – 6/3/2009. The sector returns for the 2000 – 2002 bear market are in price returns due to data availability.

The Global Industry Classification Standards, which determines MSCI and other index providers’ sector and industry classifications, changed twice during the 2010s. First Real Estate moved from an industry within the Financials sector to its own sector in 2016. Then, in 2018, the Telecom sector merged with several media-orientated industries within the Tech sector to create a new sector, Communication Services. The old Telecom sector is now the Telecommunications Services industry group within Communication services, whilst the rest of that sector falls into the Media & Entertainment industry group, which Fisher Investments UK’s research shows is more economically sensitive. Exhibit 5 shows how these new sectors performed during 2020’s bear market, with Communication Services split into its two industry groups to show the divide between the two.

Exhibit 5: Consumer Staples’ Relative Performance During the 2020 Bear Market

Source: FactSet, as of 18/1/2023. MSCI World Index and sector returns with net dividends in pounds, 20/2/2020 – 16/3/2020.

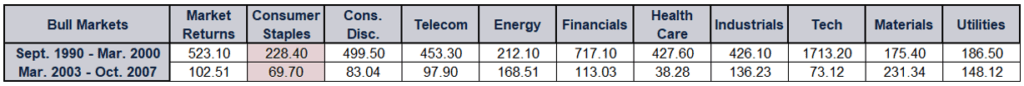

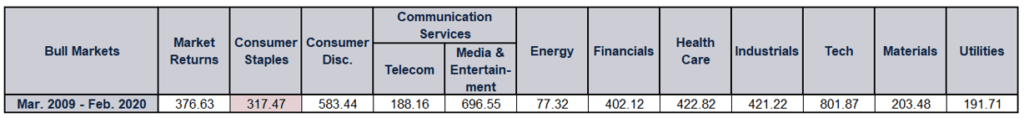

The flipside? Our research shows these companies are usually slower at growing their businesses – hindering earnings growth – often leading to bull market underperformance.

Exhibit 6: Consumer Staples’ Relative Returns During Recent Bull Markets

Source: FactSet, as of 18/1/2023. S&P 500 Index and sector monthly returns with net dividends in USD, 28/9/1990 – 27/3/2000 and MSCI World Index and sector daily returns with net dividends in pounds, 12/3/2003 – 12/10/2007. Using S&P 500 data in USD for the 1990 – 2000 bull market and sector returns as MSCI World Index sector returns do not start until 1995. Currency fluctuations between the dollar and the pound may result in higher or lower investment returns.

Exhibit 7: Consumer Staples’ Relative Returns During the 2009 – 2020 Bull Market

Source: FactSet, as of 18/1/2023. MSCI World Index and sector returns with net dividends in pounds, 6/3/2009 – 20/2/2020.

Even within the sector, not all industries are equal. Based on its returns relative to the broader sector, we find Personal Products tends to be more economically sensitive. In the 2020 bear market, it fell -17.3%, second to Beverages’ -22.7% decline and worse than the sector overall.[v] In the 2007 bear market it was the worst-performing Consumer Staples industry, down -31.4%.[vi] The others remained in single digit negatives.[vii] When Fisher Investments UK reviews the industry’s constituents, we find what we think is a simple explanation for this: many are luxury cosmetics makers, which can get hit when consumers make substitutions away from premium-priced brands during tough economic times. That said, during bull markets, in Fisher Investments UK’s view, Personal Products can give beneficial exposure to Consumer Staples for diversification.

Interested in other topics by Fisher Investments UK? Get our ongoing insights, starting with a copy of Markets Commentary.

Follow the latest market news and updates from Fisher Investments UK:

This document constitutes the general views of Fisher Investments UK and should not be regarded as personalised investment or tax advice or a reflection of client performance. No assurances are made that Fisher Investments UK will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. Nothing herein is intended to be a recommendation or forecast of market conditions. Rather, it is intended to illustrate a point. Current and future markets may differ significantly from those illustrated here. In addition, no assurances are made regarding the accuracy of any assumptions made in any illustrations herein. Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited has its registered office at: Level 18, One Canada Square, Canary Wharf, London, E14 5AX, United Kingdom. Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission.

Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission. Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.

i Source: Global Industry Classification Standard, as of 11/1/2023.

ii Source: FactSet, as of 11/1/2023. Market capitalisation of each industry as a percent of the Consumer Staples sector on 10/1/2023. Market capitalisation is the measure of the industry’s size calculated by multiplying the share prices of each company within the industry by the number of shares they have outstanding.

iii Ibid.

iv Ibid.

v Source: FactSet, as of 13/1/2023. MSCI World Index sector returns with net dividends in pounds, 20/2/2020 – 16/3/2020.

vi Ibid. MSCI World Index sector returns with net dividends in pounds, 12/10/2007 – 6/3/2009.

vii Ibid.