Legend has it Albert Einstein called compound growth the eighth wonder of the world—“the most powerful force in the universe.” However, you don’t need to be a genius to understand how compounding works.

Compounding’s core concept is earning a return on returns. Take an initial sum—your principal—and invest it. For illustrative purposes, we’ll use £100,000. Say a year later, after careful shepherding, that investment becomes £110,000—a 10% return. You enter the next year with £110,000 invested. If you earned 10% again that year—unrealistic, as markets generally don’t move in straight lines, but this is a simplistic illustration—you would finish the year with £121,000. Instead of making £10,000, like in your first year, you made £11,000! That additional £1,000 is the extra return you made by keeping your initial return invested—the return on your return. Voila—compounding. The next year, if you let your prior gains compound again, your investment becomes £133,100 at 10%, netting you an even larger £12,100. These gains may seem small in the early years. But as time moves on, compounding’s impact in positive years grows—as we will show you.

Of course, positive returns aren’t guaranteed. These scenarios use hypothetical straight-line maths which isn’t realistic. History shows the same market returns aren’t repeated consistently every year. Some years are down—sometimes big. Some are flattish. But others are up and some up big. Historically, over decades, the ups have outweighed the downs.i This doesn’t rule out lengthy downturns in the future. They are possible. But in our view, history suggests the longer you stay invested, the likelier you are to achieve positive returns. Moreover, the longer you stay invested—particularly during bull markets—the more opportunity there is for compound growth to work for you.

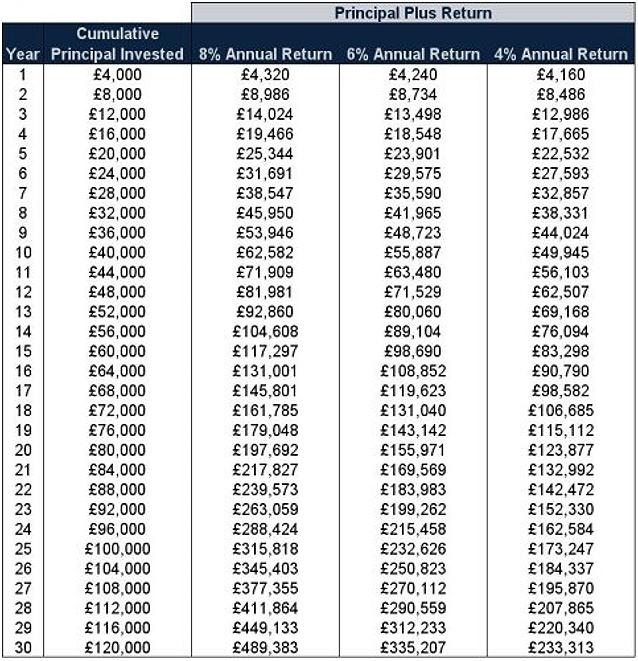

Over time, modest regular saving and investment can snowball into a large sum, thanks to compounding. Consider this hypothetical example: If you save £4,000 every year for 30 years and earn 8% annual returns—not outlandish for equitiesii —you would end up with £489,383. (Exhibit 1) Not bad for the £120,000 principal you put in, in our opinion. Time and compounding did most of the work in this hypothetical scenario. Halving those returns to 4% would still bring you £233,313. Of course, no actual experience is likely to be this smooth. But either way, this does show saving and investing’s potential power—through compounding over time—to multiply your wealth.

Exhibit 1: Hypothetical Illustration of £4,000 Annual Contributions Compounding for 30 Years at Various Rates

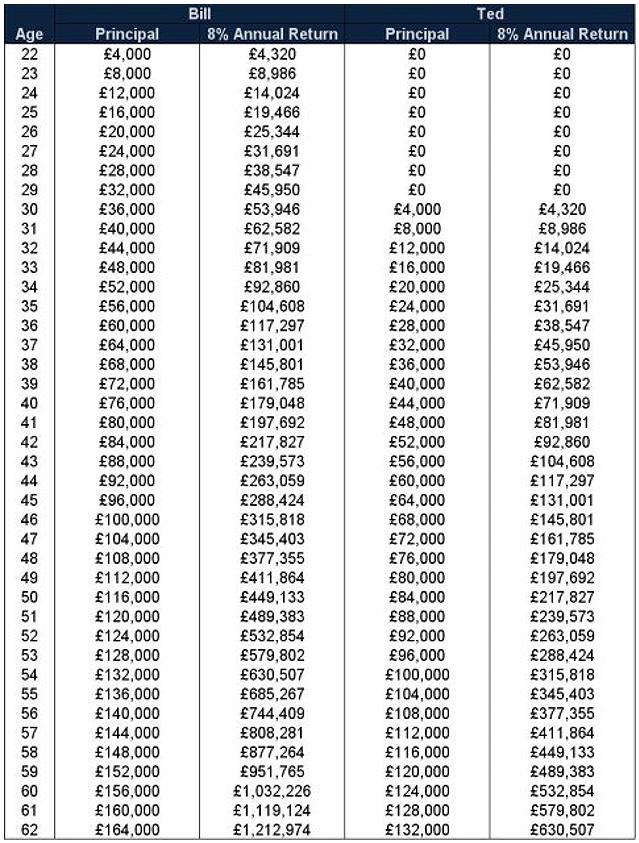

The lesson here is: The more and longer you can put your money to work, the better. As Exhibit 2 shows, delaying saving and investment by eight years lowers the ending portfolio balance significantly. Bill, our hypothetical investor on the left, started saving at age 22, socking away £4,000 annually. Ted, our hypothetical investor on the right, waited eight years before doing the same. By age 62, Bill’s savings topped Ted’s by more than half a million pounds. If at all possible, save early and invest often. The more time compound growth has to operate, the greater your chances for achieving your financial goals, in our view.

Exhibit 2: Hypothetical Illustration of the Cost of Waiting to Invest in Retirement Planning

Compounding may sound mysterious, but it isn’t. Although perhaps the closest thing there is to magic in the investing world, it is also simple mathematics, and harnessing its power is rather ordinary.

Interested in planning for your retirement? Download your free copy of The 15-Minute Retirement Plan and receive ongoing insights.

Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited has its registered office at: 2nd Floor, 6-10 Whitfield Street, London, W1T 2RE, United Kingdom.

Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission. Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.

i Source: FactSet, as of 14/3/2019. Based on MSCI World Index return with net dividends, December 1969 – February 2019.

ii Ibid. Based on average annual MSCI World Index returns with net dividends, December 1969 – February 2019.