In our survey of media publications, we have seen some commentators argue Q3’s slower eurozone growth presages recession, but we think this conclusion is premature. Growth headwinds cited in much of the recent commentary we encountered seem overstated. Meanwhile, solid underlying fundamentals indicate the eurozone’s expansion is on firm footing, in our view.

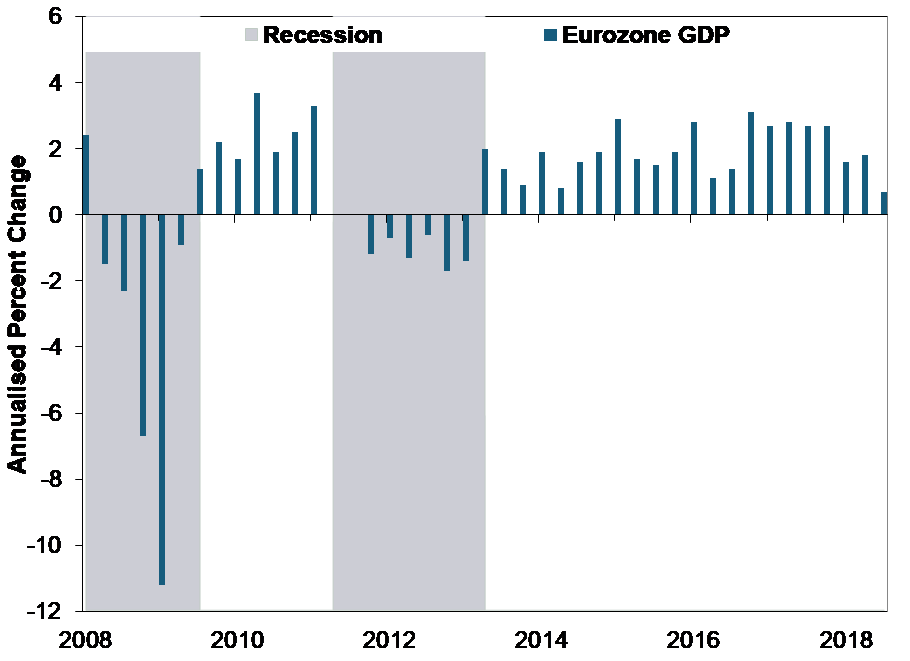

Yes, eurozone growth has slowed. Q3 eurozone gross domestic product (GDP, a government-produced measure of economic output) rose 0.7% annualised, its slowest growth rate since the recession ended nearly six years ago.i (Exhibit 1) Many focused on Germany’s -0.8% annualised Q3 GDP decline—which we think is likely a one-off stemming from new EU emissions testing regulations, which stalled vehicle production—and Italy’s deceleration to 0.1% annualised.ii Yet not all countries are weakening. France’s Q3 GDP growth accelerated to 1.7% annualised from Q2’s 0.7%; Spain’s growth edged up to 2.4% from 2.3%, and Austria sped to 1.7% growth from 1.1%.iii Whilst Q3 is far in the past, October’s purchasing managers’ indexes (PMIs) fell to two-year lows. October’s IHS Markit’s Eurozone Composite PMI—which combines manufacturing and service sector PMIs—dipped to 53.1 from September’s 54.1.iv Readings over 50 indicate expansion, but the fall signals fewer companies reported growth.

Exhibit 1: GDP Growth Has Slowed

Source: Eurostat, as of 16/11/2018. Eurozone real GDP, Q1 2008 – Q3 2018.

However, slowdowns don’t automatically translate into recession. As Exhibit 1 shows, the eurozone has experienced several slowdowns since its expansion began in 2013. In Q2 2016, GDP growth slowed from 2.8% annualised to 1.1%. But that didn’t presage sequential slowdowns. Rather, GDP reaccelerated in Q3. Slowdowns in 2014 and 2015 turned out to be blips, too, despite widespread media warnings otherwise at the time. In our view, it is wrong to presume economies follow laws of physics like momentum. Rather, quarterly data are normally variable.

Many cite global trade tensions, Italian budget disagreements and Brexit as cause for alarm today. All these fears may dampen sentiment and growth, but we wouldn’t overestimate their effect. Tariff actions to date only amount to a sliver of global economic output—less than 0.3% of global GDP—too tiny to derail expansion, in our view.v Italy’s political uncertainty may be temporarily weighing on output, but once business owners gain more clarity, we think normal commerce should resume. The same should happen, in our view, once investors gain more clarity on what Brexit will look like, enabling them to execute contingency plans as needed.

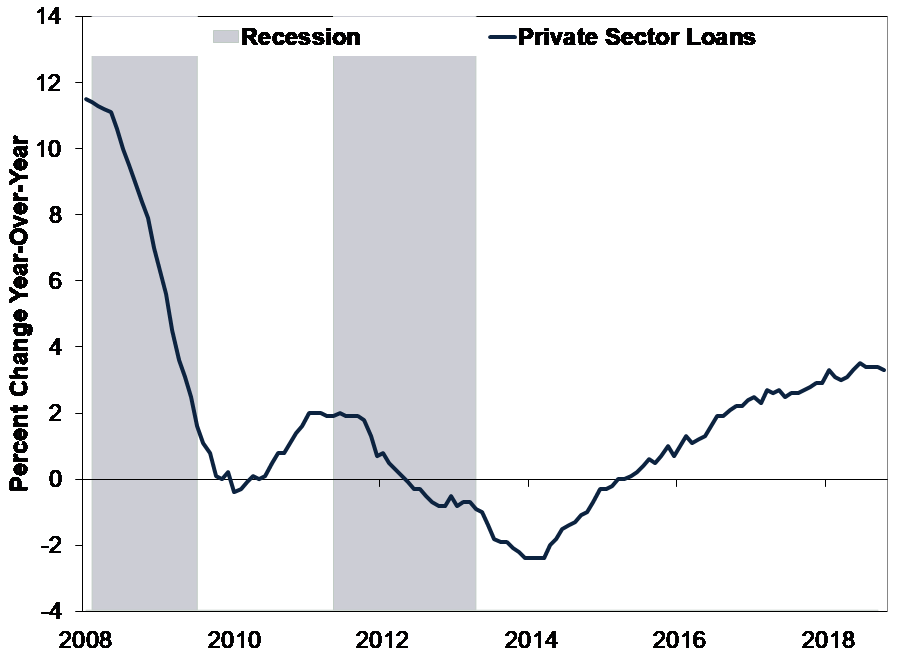

Moreover, forward-looking indicators still point to growth ahead. The yield curve—a representation of sovereign yields from one issuer or issuer type arranged from shortest to longest maturities—is positive and steepening. According to the European Central Bank (ECB), the average 10-year sovereign yield is 1.9 percentage points above the average 3-month yield.vi Over the last two years, the eurozone’s yield curve has steepened by about 30 basis points (or 0.3 percentage point).vii Lending is picking up. Because banks borrow on a short-term basis—their cost of funding—and price loans they make based on longer-term rates, the yield curve is a close proxy for their profit margins. The steeper the yield curve, the higher banks’ margins typically and the more willing they are to lend. As of October, private eurozone loans rose 3.3% y/y—near a decade-high rate.viii (Exhibit 2) The ECB’s latest Q3 bank lending survey also points to easing credit standards and financial institutions’ increased willingness to lend.ix Rising business and household demand for and access to credit should continue driving broad economic growth, in our view.

Exhibit 2: Loan Growth Has Accelerated

Source: ECB, as of 28/11/2018. Private sector adjusted loans (i.e. adjusted for loan sales, securitisation and notional cash pooling), January 2008 – October 2018.

Many in our sampling of the financial press extrapolate the eurozone’s current slowdown into a downturn, but we think this ignores many mitigating factors, implying sentiment broadly underappreciates reality. The eurozone’s economic foundations are sturdier than commonly presumed, in our view. Based on our research and analysis, these conditions provide a tailwind for markets as growth chugs along and fears fade.

Follow the latest market news and updates from Fisher Investments UK:

On Facebook

On Twitter

On LinkedIn

Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission.

Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.

iSource: Eurostat, as of 16/11/2018. Eurozone real GDP, Q1 2008 – Q3 2018.

iiSource: Eurostat, as of 16/11/2018.

iiiIbid.

ivSource: IHS Markit, as of 6/11/2018.

vSource: IMF, US Trade Representative, China Ministry of Commerce, the American Action Forum, CNN, Politico and the Peterson Institute for International Economics, as of 2/11/2018. The IMF’s estimate of nominal global GDP, in US dollars, is $87.5 trillion as of April 2018.

viSource: ECB, as of 8/11/2018. ECB “all bonds” yield curve on 7/11/2018.

viiIbid. ECB “all bonds” yield curve on 7/12/2016. The ECB announced its first asset purchase reduction on 12/8/2016.

viiiSource: ECB, as of 28/11/2018. Private sector adjusted loans (i.e. adjusted for loan sales, securitisation and notional cash pooling), October 2018.

ixSource: ECB, 22/10/2018. “The euro area bank lending survey,” Q3 2018.