It has been over a decade since Greece’s sovereign debt crisis dominated headlines in financial publications Fisher Investments UK reviews. One of the casualties from that volatile period: Greece’s developed-market status, as index provider MSCI reclassified the country an Emerging Market.[i] Things seem different today, as Greece appears on a path to restore its prior status – especially after Prime Minister Kyriakos Mitsotakis won re-election this summer, spurring buzz of ongoing reform progress amongst commentators we follow. Now many of them say a potential upgrade presents an opportunity for investors. But in our view, this is incorrect – reclassifications are generally backward-looking summaries. We think Greece’s example shows why.

Fisher Investments UK’s reviews of financial commentary find investors often consider security classifications as a starting point for building portfolios. Take Greece. If credit ratings agencies like Moody’s or Fitch classify it as a non-investment grade borrower, some investors may avoid its debt due to the purported higher default risk.[ii] Due to its Emerging Market status, investors who focus on developed-world equities may overlook Greek equities as outside the universe they invest in. Theoretically, reclassification could broaden Greece’s investment appeal, and some analysts we follow say it will boost Greek equities and bonds. But we think the evidence for this is weak.

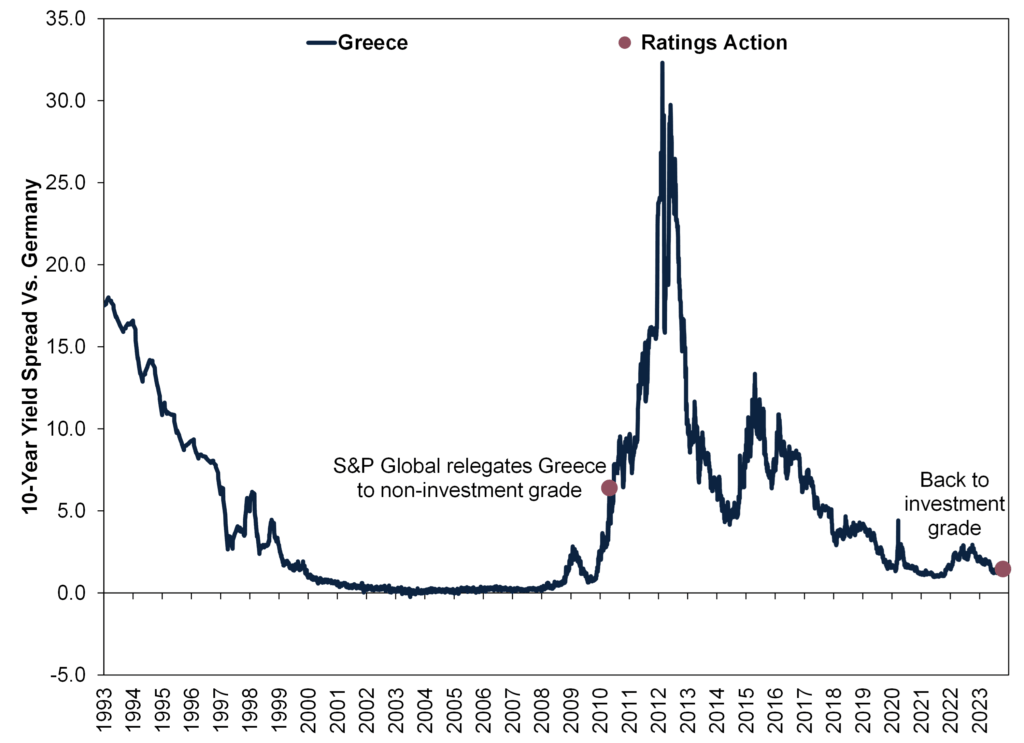

Security classifications like bonds’ credit ratings or countries’ and markets’ development status are backward looking and tend to reflect things that already happened, in Fisher Investments UK’s reviews of such situations. Exhibit 1 shows how this worked in practise in the case of Greece’s debt saga from almost 15 years ago. In October 2009, shortly after the socialist PASOK party won Greek national elections and its leader George Papandreou became prime minister, the new government announced inconsistencies in its budget calculations, revealing a much bigger deficit than earlier estimates.[iii] In the following months, Papandreou’s government outlined austerity plans to cut Greece’s deficit (e.g., a pension system overhaul and new tax system).

As these events played out, Greece’s 10-year yield widened sharply against Germany’s – commonly perceived as more creditworthy amongst analysts we follow – rising from under 1 percentage point to over 6 points before S&P Global downgraded Greek debt to non-investment grade status on 27 April 2010.[iv] This yield spread is a common tool we find many investors use to gauge shifts in market perceptions of credit quality. In Fisher Investments UK’s review, markets registered Greece’s debt crisis long before the ratings agency’s verdict.

Whilst the yield spread kept climbing thereafter, it preceded further cuts below investment grade.[v] By the time S&P Global handed Greece “the world’s lowest credit rating” on 13 June 2011, Fisher Investments UK thinks Greek yields already reflected an international bailout (May 2010) and the nation’s third austerity package to meet the bailout’s conditions (June 2010) as the country navigated the crisis.[vi]

By February 2012, yield spreads began narrowing – a month before Greece restructured its debt, writing it down by more than half in history’s biggest default.[vii] There would be more bailouts, austerity programmes, new governments and missed payments thereafter, but markets pre-priced the country’s struggles and moved first, well in advance of credit rating agencies’ formal announcements.

In July 2023, the government announced it returned to budget surpluses in the first half of the year, which helped prompt S&P Global’s 20 October promotion of Greece back to investment grade – but markets appear to have anticipated its improved creditworthiness much earlier.[viii]

Exhibit 1: Greece’s Late-Lagging Ratings Actions

Source: FactSet, as of 15/11/2023. 10-year yield spread between Greece and Germany, 1/1/1993 – 15/11/2023.

The same thinking applies to equity market classifications, in our view. Like bonds, Fisher Investments UK finds equities assess incoming information relevant to their forward-looking prospects – which encompass classification – almost instantaneously. Hence, they usually move well ahead of official industry classification changes, in our experience.

MSCI reclassified Greece to Emerging Markets on 11 June 2013.[ix] Part of the cited reason? MSCI requires at least five companies’ market capitalisations to exceed a certain threshold to qualify as a developed market, which Greece hadn’t met for two years.[x] Market capitalisation is a measure of a company’s size calculated by multiplying share price by the number of outstanding shares, and according to Fisher Investments UK’s reviews of this metric as a classification criterion, it follows market movement – another lagging assessment. Indeed, the MSCI Greece Index plunged -90.5% in the six years before its demotion, which contributed to its missing MSCI’s market capitalisation requirements.[xi] To us, using the market as a guide renders an index provider’s judgement redundant relative to what market values already imply.

Equity prices reflect the latest information, in Fisher Investments UK’s review, so markets are most likely well aware of index providers’ classification criteria – an upgrade (or downgrade) probably wouldn’t catch them by surprise, particularly since MSCI and others announce potential changes in advance.

Now Greece may be vying for developed market re-inclusion again. We wouldn’t overrate promotion though. As of early November, there were at least five Greek corporations meeting MSCI’s size requirement to consider it a developed market.[xii] If and when there is a decision to upgrade, markets would reflect it beforehand by definition. In this regard, it would be a mere formality, given nothing fundamentally changed about Greece’s equities. Reclassification doesn’t suddenly change their earnings potential. It is just a rubber stamp based on past events falling rapidly into the rearview – and incidental to equities’ main drivers, in Fisher Investments UK’s review.

Interested in other topics by Fisher Investments UK? Get our ongoing insights, starting with a copy of Markets Commentary.

Follow the latest market news and updates from Fisher Investments UK:

Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission. Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.

[i] Source: MSCI, as of 14/11/2023. Statement based on MSCI’s developed market and Emerging Market classification framework assessing countries’ economic development, size and liquidity, and market accessibility.

[ii] Source: Moody’s, as of 14/11/2023. “Ratings Scale and Definitions.”

[iii] “Greek Socialists Say Economy ‘Explosive,’ Vow Cuts,” Dina Kyriakidou, Reuters, 16/10/2009. Accessed via SWI swissinfo.ch.

[iv] “S&P Downgrades Greece Ratings Into Junk Status,” Staff, Reuters, 27/4/2010. Accessed via the Internet Archive.

[v] “S&P Hands Greece World’s Lowest Credit Rating,” George Georgiopoulos and Walter Brandimarte, 13/6/2011. Accessed via the Internet Archive. “The Events That Pushed Greece to the Economic Brink,” Staff, The Wall Street Journal, 13/7/2015.

[vi] Ibid.

[vii] Ibid.

[viii] “Greek Gov’t Budget Deficit Turns Into Surplus,” Staff, eKathimerini.com, 20/7/2023. “S&P Upgrades Greece to Investment Grade for First Time Since 2010 Crisis,” Staff, Reuters, 20/10/2023. Accessed via eKathimerini.com.

[ix] “MSCI Announces the Results of the 2013 Annual Market Classification Review,” Staff, MSCI, 11/6/2013.

[x] “MSCI Market Classification Framework,” Staff, MSCI, June 2023.

[xi] Source: FactSet, as of 15/11/2023. MSCI Greece price index, 11/6/2007 – 11/6/2013. Presented in euros. Currency fluctuations between the pound and euro may result in higher or lower returns.

[xii] Source: FactSet, as of 13/11/2023. Statement based on MSCI Greece constituents’ market capitalisation.