A common perspective in financial publications Fisher Investments UK reviews is that consumers’ feelings determine their actions – which implies emotions can have broader economic implications. Hence, many look to gauges of consumer sentiment or confidence as indicators of future behaviour. And, hence, a gauge of economic activity and future sales for publicly traded firms. But, based on Fisher Investments UK’s research, such gauges aren’t reliable predictors of economic activity. Feelings, it seems, are fickle.

It may seem intuitive feelings foretell action. Someone may feel unhappy about their financial situation or concerned about economic conditions at large, which may encourage them to save rather than buy something. But according to Fisher Investments UK’s reviews of investors’ behaviour, human emotions can change quickly. For instance, someone worries about their financial situation one day, but the next day, they see a coveted item on sale. They end up making the purchase, convinced it was a good deal – in this case, lower prices overcame personal feelings.

In our experience, many times consumers say things are bad for the overall economy – perhaps picking up on the tenor of coverage or recent stock market chop – but consider their own personal situation much better. More familiarity breeds more personal confidence than in the abstract overall economy. Here, the personal likely influences behaviour more than the broad, disconnected view.

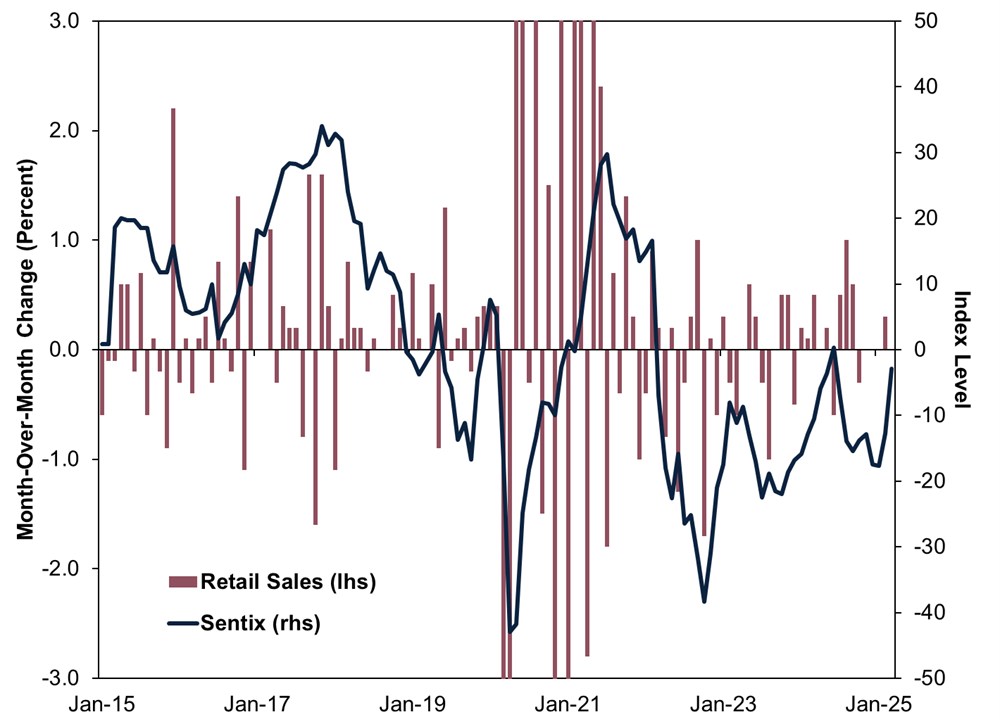

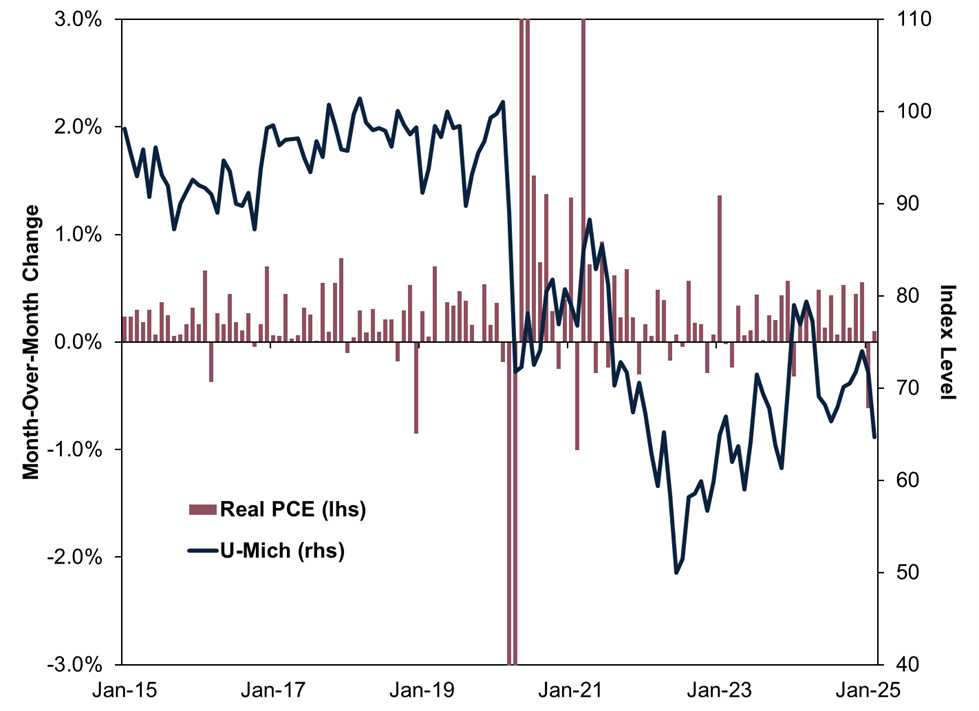

One way to show the lack of connection between how people say they feel and how they spend: comparing how consumer sentiment polls align with spending measures. If there was a strong relationship between feelings and action, Fisher Investments UK would expect to see spending fall when moods are down and vice versa. But as Exhibits 1 – 3 suggest, reality is more complex.

See how eurozone retail sales align with the Sentix economic index, a widely watched poll aggregating respondents’ assessment of the current situation as well as their economic expectations. There are stretches in the late 2010s when eurozone sales fell whilst the Sentix index was rising. Moreover, the Sentix index has been negative for much of the past three years – yet retail sales haven’t continually fallen throughout that period.

Exhibit 1: Eurozone Retail Sales and the Sentix Economic Index

Source: FactSet, as of 14/4/2025. Retail Sales Y-axis truncated at 3.0 and -3.0 due to lockdown-related extremes that would make the chart unintelligible.

Research firm GfK compiles a consumer confidence measure for the UK. As in the eurozone, GfK’s consumer confidence gauge has weakened over the past three years and remains well off 2021’s highs – but that hasn’t deterred UK consumers from shopping. (Exhibit 2)

Exhibit 2: UK Retail Sales and the GfK Consumer Confidence Index

Source: FactSet, as of 14/4/2025. Retail Sales Y-axis truncated at 4.0% and -4.0% due to lockdown-related extremes that would make the chart unintelligible.

Perhaps most illustrative, in Fisher Investments UK’s view: how US personal consumption expenditures (PCE, the broadest measure of US spending) aligns with the University of Michigan’s widely followed consumer sentiment poll. US consumer spending has steadily climbed despite consumers’ reporting feeling worse about the economic situation for the past half decade.

Exhibit 3: US PCE and the University of Michigan’s Consumer Sentiment Index

Source: FactSet, as of 14/4/2025. Consumer spending Y-axis truncated at 3.0% and -3.0% due to lockdown-related extremes that would make the chart unintelligible.

In our view, investors benefit from not treating consumer attitudes as a predictor of the economy’s future health. Besides feelings saying little about future actions, our research has found consumer spending is generally stable. Households tend to buy essentials (e.g., housing, healthcare, utilities) regardless of the economic environment. If times are tough, discretionary purchases are usually the first to go – which makes them a response to economic conditions, not a cause. This isn’t to say such surveys are utterly useless. They can hint at prevailing economic and investor sentiment, based on Fisher Investments UK’s reviews of popular datasets. Whilst not perfect or complete looks, we think surveys do offer some insight.

With this understanding, investors can prepare themselves when headlines suggest consumer moods may hinder or boost spending, thereby affecting the economy at large. Knowing what to focus on – and what to put to the side – can assist investors when analysing investment opportunities.

Interested in other topics by Fisher Investments UK? Get our ongoing insights, starting with a copy of Markets Commentary.

Follow the latest market news and updates from Fisher Investments UK:

This document constitutes the general views of Fisher Investments UK and should not be regarded as personalised investment or tax advice or a reflection of client performance. No assurances are made that Fisher Investments UK will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. Nothing herein is intended to be a recommendation or forecast of market conditions. Rather, it is intended to illustrate a point. Current and future markets may differ significantly from those illustrated here. In addition, no assurances are made regarding the accuracy of any assumptions made in any illustrations herein. Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited has its registered office at: Level 18, One Canada Square, Canary Wharf, London, E14 5AX, United Kingdom. Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission.

Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission. Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.