Do above-average equity returns mean worse ones lie ahead – and vice versa? Much of the commentary Fisher Investments UK reviews when surveying financial headlines implies the answer is yes. Whilst the concept of mean reversion in markets – that equity returns revert to their long-term average if they deviate from it – may seem intuitive, it is fundamentally flawed, in our view. Here we explain why we think it doesn’t work and how it can lead investors astray.

The law of averages can be alluring, but for investors, we think it is unhelpful. It supposes equities regularly deliver their historical average return – and in the event of an above-average or below-average return, they must correct in the opposite direction sooner rather than later. However, returns don’t work that way, based on Fisher Investments UK’s reviews of financial market history.

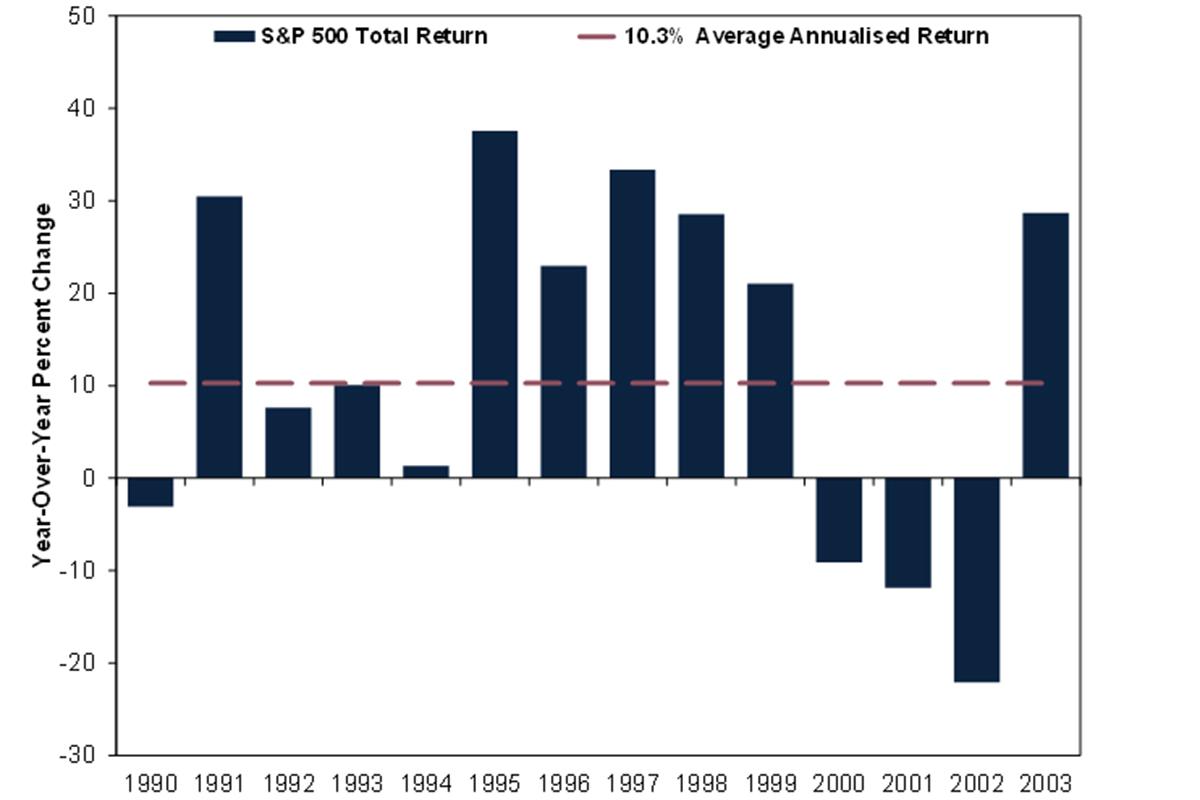

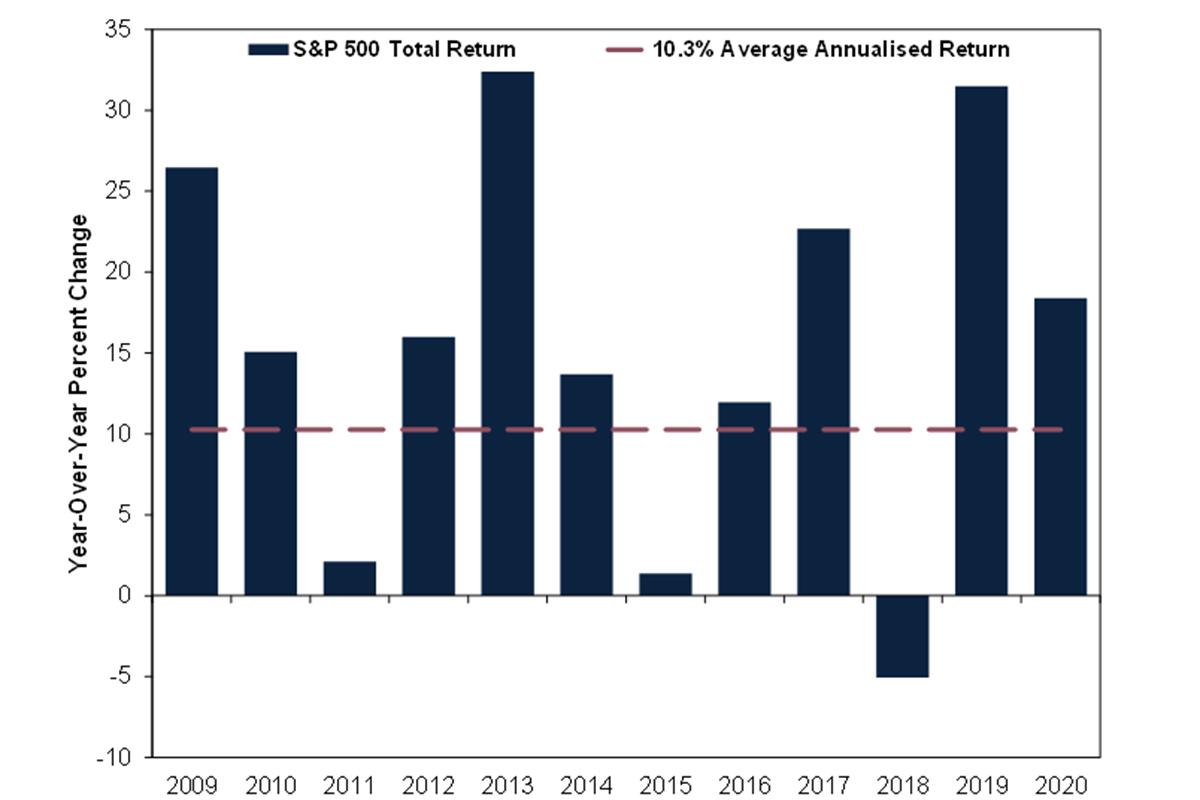

Take America’s S&P 500 for its long history. Since 1926, its average annualised return has been 10.3% in US dollars.[i] Looking at calendar year returns, as Exhibits 1 and 2 show, it becomes apparent that average returns aren’t typical. They often consist of extremes any given year, which tend to clump together, but not always. This is because although equities generally rise over time (bull markets), they are sometimes punctuated by fundamentally driven declines exceeding -20% (bear markets). Whilst one always follows the other, according to our analysis, investors can only know when in hindsight (They also seldom line up precisely with calendar years). When Fisher Investments UK reviews market cycles, we find no discernible pattern based on returns alone.

Exhibit 1: Markets Usually Move Up, but Unpredictably (1990 – 2003)

Source: Global Financial Data, Inc., as of 31/10/2024. S&P 500 total returns, 1990 – 2003. Presented in US dollars. Currency fluctuations between the dollar, euro and pound may result in higher or lower investment returns.

Exhibit 2: Markets Usually Move Up, but Unpredictably (2009 – 2020)

Source: Global Financial Data, Inc., as of 31/10/2024. S&P 500 total returns, 2009 – 2020. Presented in US dollars. Currency fluctuations between the dollar and pound may result in higher or lower investment returns.

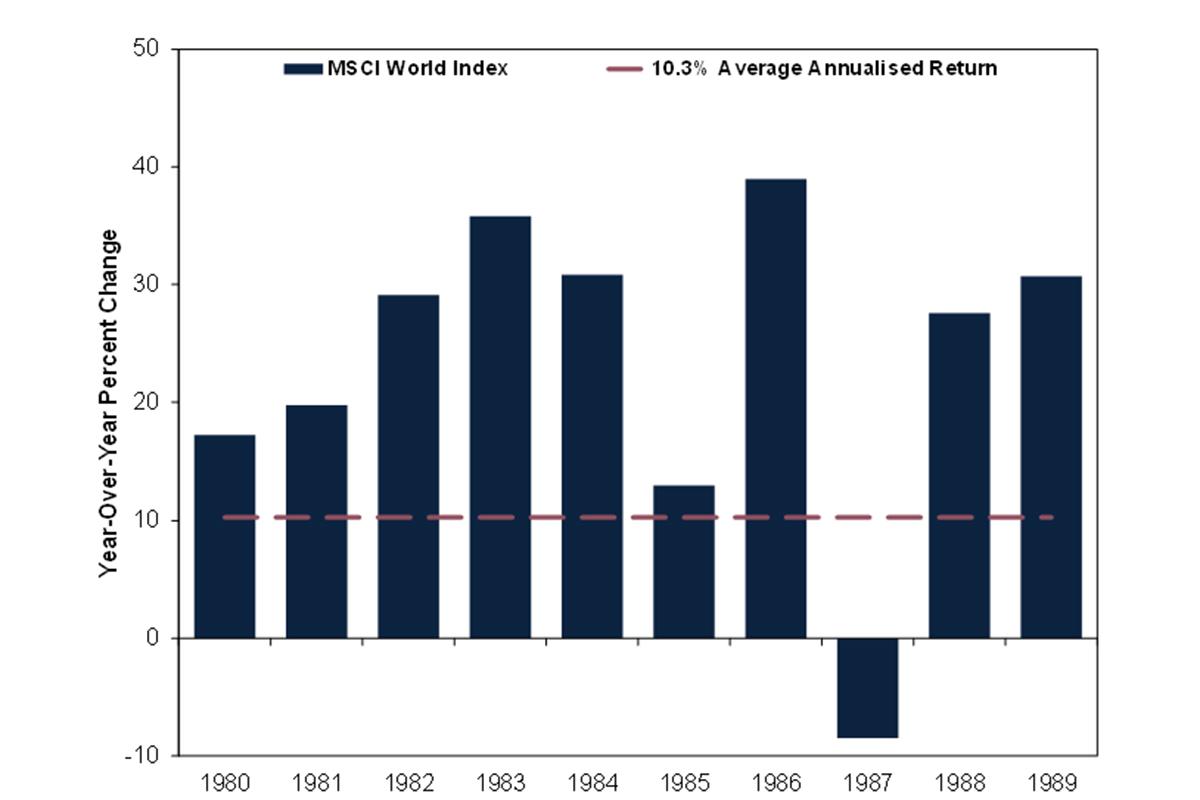

Whilst it has a shorter history, the MSCI World Index’s average annualised return in pounds is also 10.3% since 1970.[ii] Again, Fisher Investments UK’s reviews of global equity returns show markets aren’t mean reverting: Above-average returns often come in clumpy patches here, too.

Exhibit 3: Globally, Too (1980 – 1989)

Source: FactSet, as of 31/10/2024. MSCI World Index returns with net dividends, 1980 – 1989. Presented in pounds.

The simple reason markets don’t mean revert: Past prices don’t predict. By itself, just because a price was up (or down) yesterday, doesn’t mean it will be down (or up) tomorrow. The same goes for any other timeframe – week, month, year or decade – according to Fisher Investments UK’s reviews of market history. Statistically speaking, prices aren’t serially correlated, as one period’s movement says nothing about the next. It is like a coin flip, in which each toss is independent of the last. Five heads in a row doesn’t mean the next flip is more likely to be tails. If the past did predict, then a rising equity would always keep rising (and vice versa). But this isn’t so.

Consider this imaginary scenario for illustrative purposes only: Susan buys equity in hypothetical company OTQC at £50, and it rises to £100. Seeing it go up, Anthony then buys some OTQC at £100. But then OTQC’s price falls to £80 – a -20% drop. Should they both sell at £80? Susan may still believe OTQC is great, given the gains from her perspective. But after enduring a paper loss, Anthony could be regretting his decision and feel the urge to sell. Who is correct? Fisher Investments UK sees no right answer because past performance isn’t indicative of future results.

Rather than dwell on past price movements, we suggest focussing on what lies ahead. In our experience, the gap between earnings expectations and reality – roughly 3 to 30 months ahead – moves equities most. Sentiment toward past prices can affect expectations. But over the longer term, we have found forward-looking fundamentals – earnings’ outlook versus their actual path – matter more.

When Fisher Investments UK reviews financial publications’ market analysis, we find they frequently fall prey to mean-reversion fallacies, which may make it difficult for investors to shake off. But in our view, knowing past averages don’t control markets’ future returns frees you to focus on what does, which we think helps you become a better investor.

Interested in other topics by Fisher Investments UK? Get our ongoing insights, starting with a copy of Your Net Worth.

Follow the latest market news and updates from Fisher Investments UK:

This document constitutes the general views of Fisher Investments UK and should not be regarded as personalised investment or tax advice or a reflection of client performance. No assurances are made that Fisher Investments UK will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. Nothing herein is intended to be a recommendation or forecast of market conditions. Rather, it is intended to illustrate a point. Current and future markets may differ significantly from those illustrated here. In addition, no assurances are made regarding the accuracy of any assumptions made in any illustrations herein. Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited has its registered office at: Level 18, One Canada Square, Canary Wharf, London, E14 5AX, United Kingdom. Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission.

Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission. Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.

[i] Source: Global Financial Data, Inc., as of 31/10/2024. S&P 500 total return, December 1925 – October 2024. Presented in US dollars. Currency fluctuations between the dollar, euro and may result in higher or lower investment returns. An annualised return is the yearly rate required to reach the ending value from inception.

[ii] Source: FactSet, as of 31/10/2024. MSCI World Index returns with net dividends, December 1969 – October 2024. Presented in pounds.