When Fisher Investments UK reviews how people analyse equity returns, we find they often look at price movement only: whether the price of a security they bought is higher or lower than what they paid. But this doesn’t always account for everything. In our view, tracking total returns provides investors with a more complete picture of their investment.

For equities, the total return is any price change plus reinvested dividends. What are reinvested dividends? Some companies return capital to their shareholders in the form of a cash payment out of their shares: a dividend. If a hypothetical company’s equity price is £10 per share and it issues a £1 dividend, then that reduces its equity price to £9 per share. A shareholder could choose to pocket the dividend, but notice: their price-only return on the day the dividend is paid is -10%, which might seem shocking! Until you consider the dividend. The concept of reinvested dividends adds back the dividend to the price, presuming the investor chooses to use the proceeds from the dividend to buy more shares in the same company.

Hence, an equity’s total return includes all dividend distributions the company pays and assumes they are reinvested in its shares – alongside the price change over any given time period. We find total return provides a more accurate assessment of all the ways an equity may benefit shareholders. Looking at an equity’s price returns only – excluding dividend payments – omits both the cash payment and the amount it appreciates (or depreciates) when it is reinvested. This is true for both individual securities and the stock market’s performance as a whole, in Fisher Investments UK’s view.

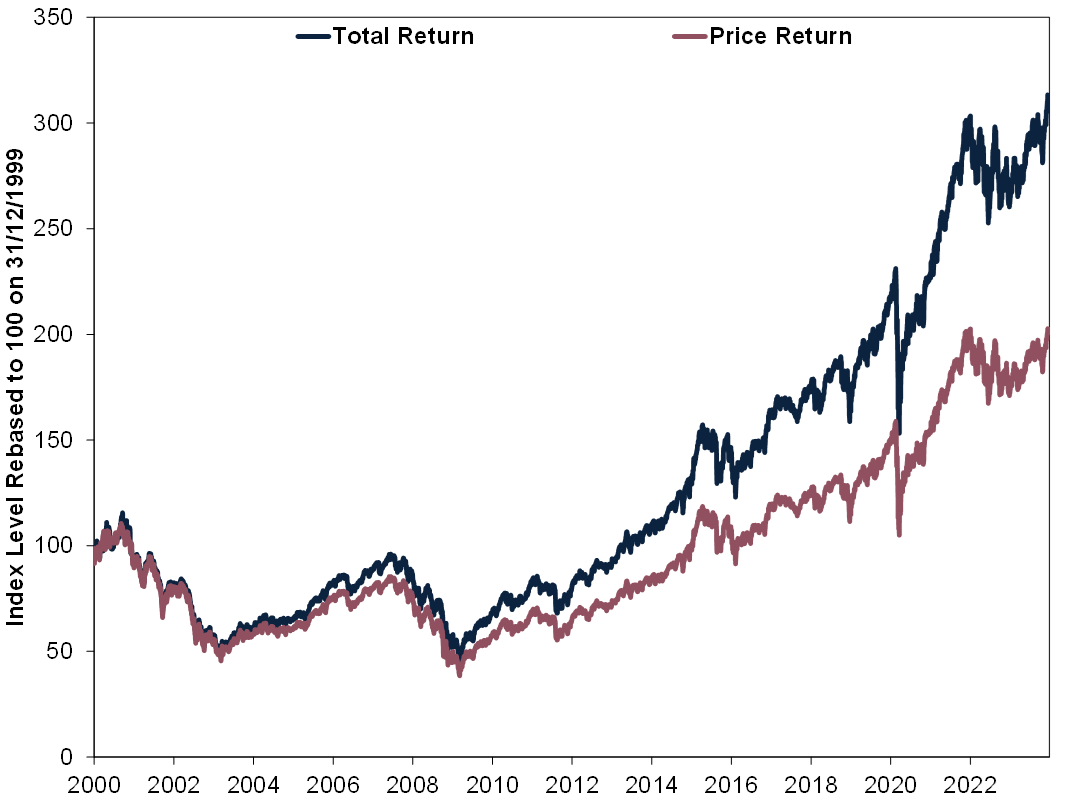

Take the MSCI World Index, for example, in Exhibit 1. From the beginning of 2000 to 2023’s end, its price-only return is 102.4%, which may sound rather large.[i] But compare it to the 213.1% return with reinvested dividends.[ii] The MSCI World Index’s total return is more than twice its price return – quite a big gap!

Exhibit 1: MSCI World Index Price and Total Returns

Source: FactSet, as of 15/10/2024. MSCI World Index price returns and returns with net dividends (total returns), 31/12/1999 – 31/12/2023. Presented in euros. Currency fluctuations between the euro and the pound may result in higher or lower investment returns.

Reinvested dividends contributed a substantial amount to long-term investors’ total returns. Based on Fisher Investments UK’s reviews of investors’ perceptions, this can make a big difference if they aren’t accounted for. That is why we think it is worth the extra effort to calculate total returns rather than relying simply on price returns only.

What about bonds? Accounting for their return components is somewhat different. A bond’s total return is any change in the bond’s price (up or down) plus interest received. It is usually the latter investors tend to focus on most, in our experience – the regular interest a bond pays – which is why when you buy a bond, outlets Fisher Investments UK reviews frequently quote its yield prominently. However, a bond’s total return can diverge substantially from its yield. Not only can a bond investor accumulate gains from periodic coupon payments, but the value of the bond when you sell it – or when it matures (whereby the issuer pays the bond’s face value, or principal, to the holder) – may be higher or lower than its purchase price.

Consider a hypothetical bond with a face value of £1000 that matures in 5 years and pays you 2% – or £20 in coupons annually. If interest rates rose to 3%, the bond’s price in the open market would fall because its coupon would still be £20, whereas new issues would pay £30. If the owner wanted to sell, they would have to mark the price down until its yield equalled 3%, lowering its total return. But if interest rates fell, the bond’s price would rise as its coupon’s attractiveness increased, lifting total returns.

Total returns not only allow you to gauge how well securities have done within an asset class but between asset classes. Whilst price and yield matter, they aren’t everything, and leaving out return components can distort the picture. In Fisher Investments UK’s review, accounting for dividends and/or interest as well as price movement is the only way to make valid apples-to-apples comparisons. You may have to do some extra digging to determine them. But we think it helps to get an accurate reflection of reality – and your finances.

Interested in planning for your retirement? Get our ongoing insights, starting with The Definitive Guide to Retirement Income.

Follow the latest market news and updates from Fisher Investments UK:

This document constitutes the general views of Fisher Investments UK and should not be regarded as personalised investment or tax advice or a reflection of client performance. No assurances are made that Fisher Investments UK will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. Nothing herein is intended to be a recommendation or forecast of market conditions. Rather, it is intended to illustrate a point. Current and future markets may differ significantly from those illustrated here. In addition, no assurances are made regarding the accuracy of any assumptions made in any illustrations herein. Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited has its registered office at: Level 18, One Canada Square, Canary Wharf, London, E14 5AX, United Kingdom. Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission.

Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission. Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.

[i] Source: FactSet, as of 15/10/2024. MSCI World Index price return, 31/12/1999 – 31/12/2023. Presented in euros. Currency fluctuations between the euro and the pound may result in higher or lower investment returns.

[ii] Source: FactSet, as of 15/10/2024. MSCI World Index return with net dividends (total return), 31/12/1999 – 31/12/2023. Presented in euros. Currency fluctuations between the euro and the pound may result in higher or lower investment returns.