From Russia’s war in Ukraine to renewed violence in the Middle East – not to mention worries of more – recent regional conflicts are unquestionably tragic, and our hearts go out to all involved. Whilst it might seem callous to think about these tragedies from an investment perspective, commentators we follow can be quick to do so – often weighing the potential economic or market fallout. But Fisher Investments UK’s reviews of market history show that whilst regional conflicts can drag on sentiment in the short term, they usually lack the power to have a material, lasting economic impact.

Based on Fisher Investments UK’s research, the onset of regional conflicts can prompt commentators to speculate on local economic disruptions’ potential greater impact. For instance, when conflict in the Middle East began in October 2023, some warned the ensuing production interruptions in a major energy-producing region could send European prices skyward – and even reignite hot inflation (broadly rising prices across the economy).[i] Or, when Russia’s February 2022 invasion triggered Western sanctions, publications we follow forecasted food and energy shortages across Europe and beyond. This wasn’t surprising to us considering Europe’s decades-long dependency on Russian energy and Ukraine’s role as an agricultural and food products exporter.[ii] Moreover, regional strife can stir projections of a broader spillover that entangles additional nations, potentially disrupting global commerce. These feared possible outcomes (and others) can drag sentiment down.

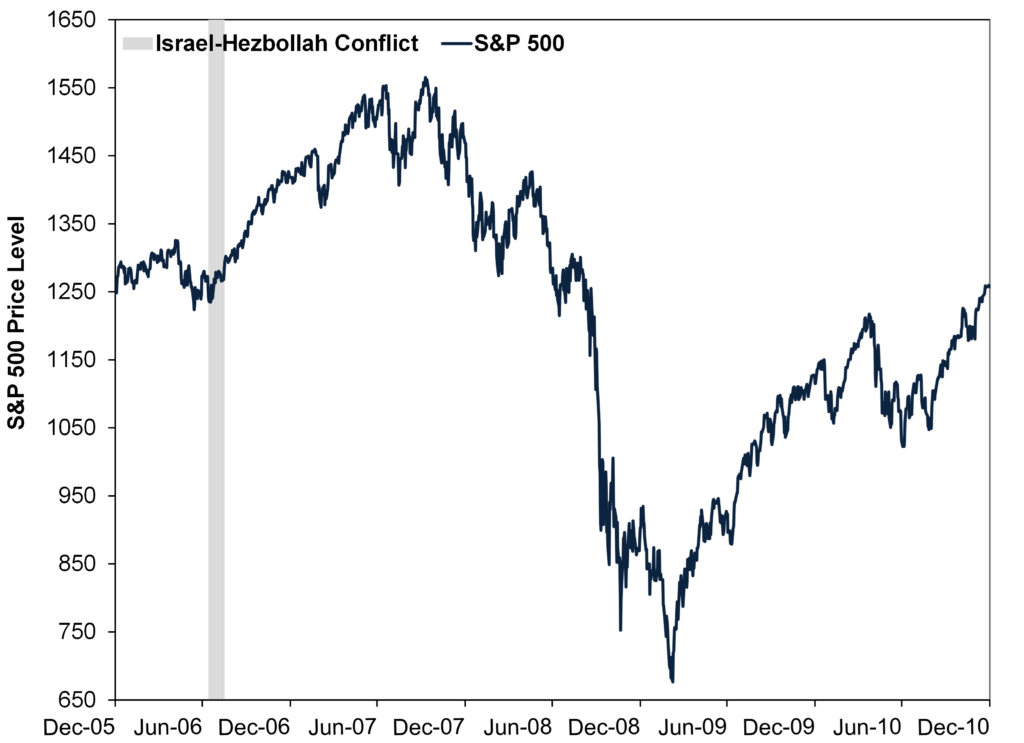

That said, markets have a long history of overcoming regional conflicts. Fisher Investments UK’s reviews of market history show that equities may fall in the run-up to fighting, but that volatility tends to fade afterwards. There are plenty of examples of this. Using America’s S&P 500 index for its long and reliable history, first consider how markets dealt with the Israel-Hezbollah conflict of the mid-2000s. As Exhibit 1 shows, equities fell months before the fighting started in July 2006, but once the conflict began, markets rebounded.

Exhibit 1: Israel-Hezbollah Conflict and Equities

Source: FactSet, as of 21/11/2013. S&P 500 price index, 31/12/2005 – 31/12/2010. Presented in US dollars. Currency fluctuations between the dollar and the pound may result in higher or lower investment returns.

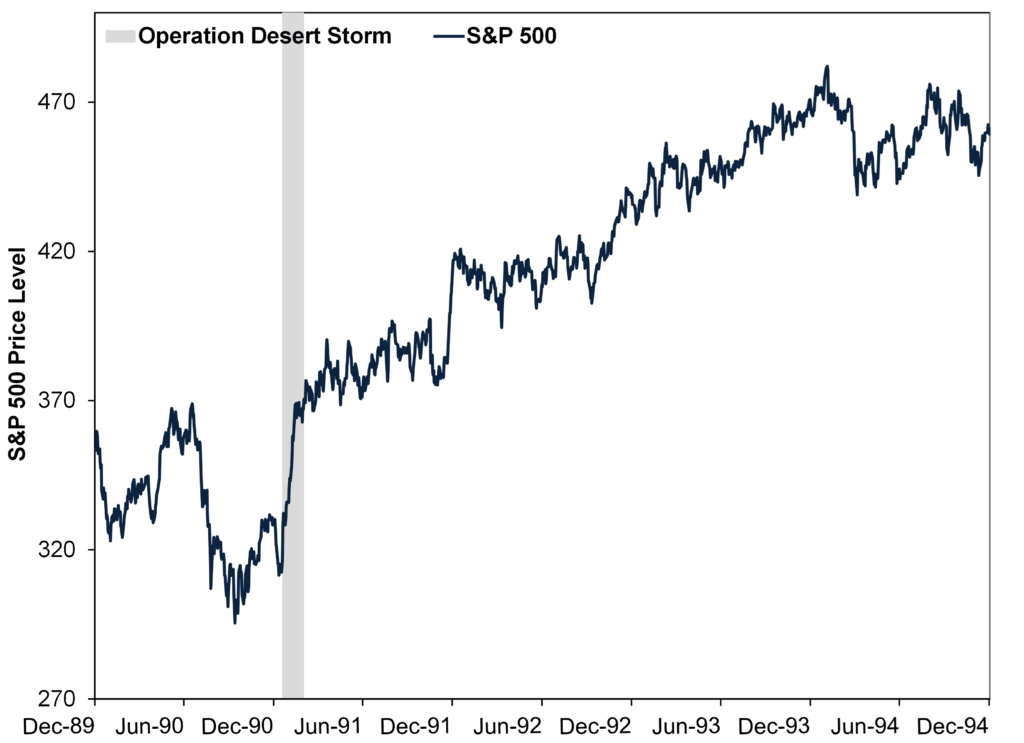

Exhibit 2 shows how equities fared before, during and after Operation Desert Storm in the early 1990s – which paints a similar picture, in Fisher Investments UK’s review.

Exhibit 2: Operation Desert Storm and Equities

Source: FactSet, as of 21/11/2013. S&P 500 price index, 31/12/1989 – 31/12/1994. Presented in US dollars. Currency fluctuations between the dollar and the pound may result in higher or lower investment returns.

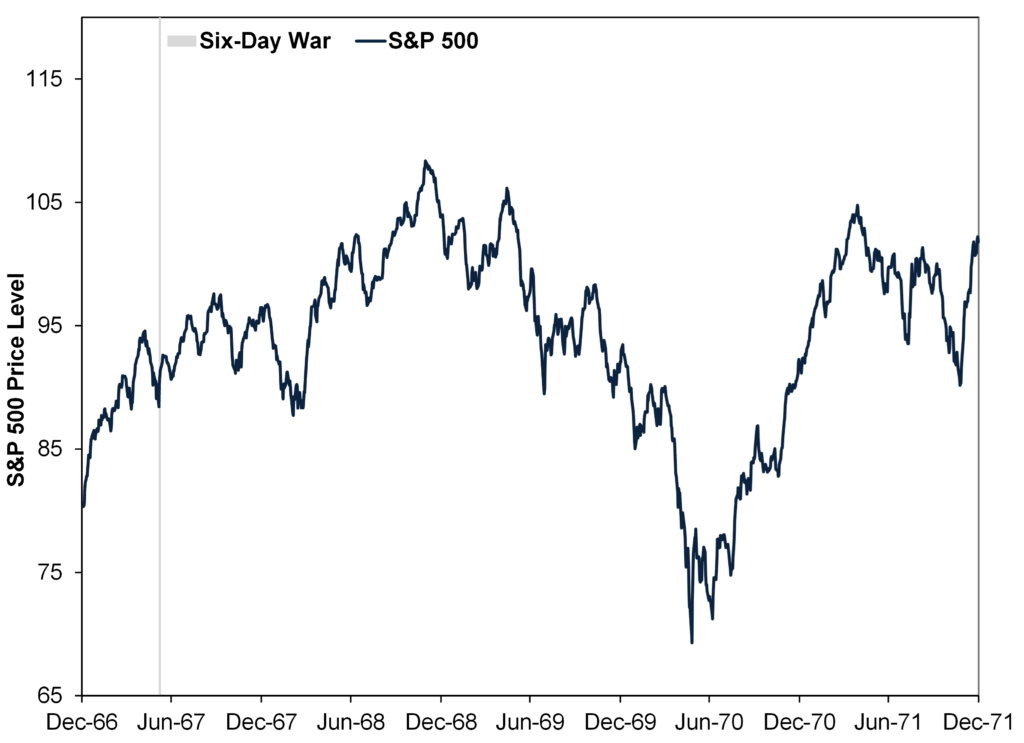

Going further back, Exhibit 3 shows equities’ performance around the Six-Day War in 1967.

Exhibit 3: The Six-Day War and Equities

Source: FactSet, as of 21/11/2013. S&P 500 price index, 31/12/1966 – 31/12/1971. Presented in US dollars. Currency fluctuations between the dollar and the pound may result in higher or lower investment returns.

In our view, the uncertainty surrounding these conflicts is what knocks sentiment most. As horrific and tragic as these events are, we find fighting alone isn’t enough to derail markets. Our research shows equities care most about how events may impact corporations’ future earnings, which Fisher Investments UK finds hinge on economic conditions globally. As it becomes apparent the fighting is unlikely to spread beyond its particular locale or region – limiting the global economic impact – uncertainty begins to fade, and equities price in the probability reality is milder than expected.

Now, 2022 may seem like a counterexample, as Russia’s invasion of Ukraine occurred early in a global bear market in US dollars.[iii] However, our research shows that Eastern European conflict was just one of a cornucopia of negative factors impacting global markets that year – some of which it contributed to, like energy supply concerns and inflation, and some that were unrelated. In Fisher Investments UK’s review, it was that whole panoply of fears – which also included monetary policymakers’ interest rate hikes and ongoing supply chain problems – that caused sentiment to weigh on equities so heavily.[iv] Furthermore, the Russia-Ukraine war is still raging as we write, and yet, global equities are around all-time highs in US dollars.[v] Seems to us markets have moved on.

In Fisher Investments UK’s review, most regional conflicts – by themselves – lack the power to have a material, lasting economic impact. That doesn’t mean war has no effect on equities. Fighting can hit local markets, and according to our research, major, global wars capable of deleting enough economic activity to cause a decline in global output – think World War II – can cause bear markets. But localised conflicts affect a much smaller portion of the global economy, muting their impact. For instance, together, Russia and Ukraine account for less than 3% of world gross domestic product.[vi] Israel and Gaza? Less than 1%.[vii]

Regional conflicts can hurt local economies or geographical regions, but in a global economy, other nations can step in. For example, Western sanctions on Russia didn’t cause global oil markets to screech to a halt – Russia found buyers who didn’t comply with sanctions (e.g., India and China), whilst producers elsewhere (most notably, America) ramped up production.[viii] Global oil supply didn’t dry up. Fisher Investments UK’s reviews of market history show this type of adaptability also mutes regional conflicts’ greater economic impact.

Interested in other topics by Fisher Investments UK? Get our ongoing insights, starting with a copy of Markets Commentary.

Follow the latest market news and updates from Fisher Investments UK:

This document constitutes the general views of Fisher Investments UK and should not be regarded as personalised investment or tax advice or a reflection of client performance. No assurances are made that Fisher Investments UK will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. Nothing herein is intended to be a recommendation or forecast of market conditions. Rather, it is intended to illustrate a point. Current and future markets may differ significantly from those illustrated here. In addition, no assurances are made regarding the accuracy of any assumptions made in any illustrations herein. Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited has its registered office at: Level 18, One Canada Square, Canary Wharf, London, E14 5AX, United Kingdom. Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission.Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission. Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.

[i] “‘Fraught With Uncertainty’: IEA Says Oil Markets to Remain on Tenterhooks as Israel-Hamas War Persists,” Sam Meredith, CNBC, 12/10/2023.

[ii] Source: European Commission and US Department of Agriculture, as of 11/1/2024.

[iii] Source: FactSet, as of 11/1/2024. MSCI World Index return with net dividends in USD, 4/1/2022 – 12/10/2022. Currency fluctuations between the dollar and the pound may result in higher or lower investment returns. A bear market is a prolonged, fundamentally driven broad equity market decline of -20% or worse.

[iv] Source: FactSet, as of 11/1/2024. Statement based on monthly CPI and CPIH readings in the US, UK and eurozone countries and government-set short-term interest rates across developed economies, January 2022 – December 2022.

[v] Source: FactSet, as of 11/1/2024. MSCI World Index price in USD, 31/12/2020 – 11/1/2024. Currency fluctuations between the dollar and the pound may result in higher or lower investment returns.

[vi] Source: World Bank, as of 3/1/2024. Gross domestic product, or GDP, is a government-produced measure of economic output.

[vii] Ibid.

[viii] Source: US Energy Information Administration, as of 11/1/2024. “Russia Says Redirected Most Oil Exports to China, India,” Staff, AFP. Accessed via Yahoo! News.