When things go right, how often do you presume it is only a matter of time before the fun ends? Or during tough times think, “they can only get worse.” Optimists might think something good has to happen – it is due. Whether in everyday life or market activity, these sentiments seem to be pretty common. We find people often tend to both extrapolate the recent past forward and presume the law of averages will take hold, pulling reality toward the long-term mean. We see this often from financial commentators we follow. Even though most financial literature we review stresses past performance doesn’t predict future returns, we find investors often act as if they presume it does – perhaps even without realising it. Let Fisher Investments UK explore these pitfalls and how to spot them. We aren’t arguing that investors consciously think past performance predicts. But that fallacy often underlies a number of common assumptions, in our view.

When markets are bad, many commentators whose work Fisher Investments UK reviews warn downturns will continue. Similarly, throughout market history, observers occasionally fall into euphoric patches believing this time is different and markets can’t fail. Many commentators also often imply averages – created by past returns – are predictive. We see this frequently in statements like, “equities are due for a recovery.” We also see this in Fisher Investments UK’s review of professional forecasts, which often project sagging returns after very good years. All seemingly rest on the assumption the S&P 500’s long-term average return of about 10% annualised since 1926 has a gravitational force.i

The same logic often seems to apply to price-to-earnings ratios (or companies’ share prices divided by their corporate profits) – commentators we follow frequently argue valuations must revert to the mean, taking equities lower or higher as they do. This year is no different. We find analysis of the S&P 500’s returns particularly insightful as the S&P 500 provides a long history of quality data, dating back to 1925. Take financial publications’ commentary on the S&P 500’s performance as markets passed the 30 June 2022 halfway point: the fact that S&P 500 returns in dollars in 2022’s first half were the worst since 1962 stole many headlines in publications Fisher Investments UK reviews.ii Some observers argued this augurs poorly for the second half. Other commentators argued a recovery must be imminent simply because bad first halves have preceded good second halves. But coincidence isn’t causality. A broader look at the data shows first halves don’t predict second halves.

The correlation coefficient between the S&P 500’s first and second-half returns dating back to 1925 is -0.099.iii A correlation coefficient – ranging from 1.0 to -1.0 – measures the relationship between two variables. A 1.0 coefficient means they always move together, zero means there is no relationship and -1.0 means they always move in opposite directions. Whilst the -0.099 correlation means first- and second-half S&P 500 returns moved in opposite directions slightly more often than not, we think it is functionally meaningless. According to Fisher Investments UK’s review of historical data, returns aren’t serially correlated over any time period – meaning, our research shows one period’s market movement doesn’t predict the next. Again, we look at S&P 500 year-over-year returns for their long history of quality data.

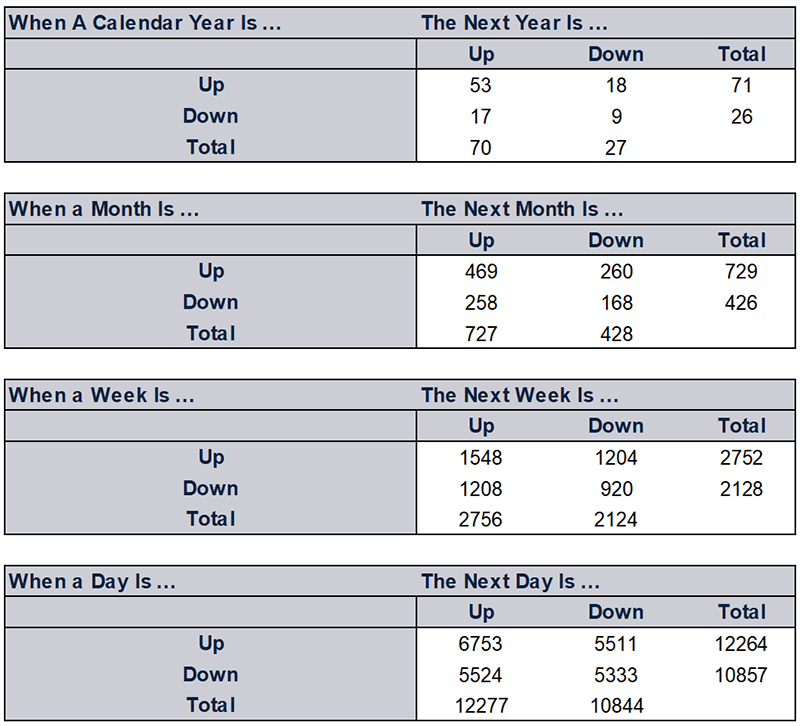

The correlation coefficient between one year of S&P 500 returns and the next is -0.008 – basically zero.iv As Exhibit 1 shows, of the 26 years the S&P 500 was down, the next year’s index returns were up 17 times and down 9. So, does this mean down years predict up years for the S&P 500, or other indexes for that matter? No, we think it just means equities rise the majority of the time, and a year is often a long enough stretch to even out very short-term wobbles. Case in point: of the 71 up years for the S&P 500, the next year’s returns were up 53 times and down 18. Shorter time periods show more randomness. Again, relying on S&P 500 returns for their long history, monthly returns have an ever-so-slightly positive correlation of 0.077 – still insignificant, in our view – with returns after positive months up 64.5% of the time and down 35.5%.v After down months, S&P 500 returns were positive 60.6% of the time and down 39.3%. Weekly and daily S&P 500 returns – with 0.004 and 0.000 correlations, respectively – were even more scattershot.

Exhibit 1: are Past Returns Predictive?

Source: Global Financial Data and FactSet, as of 12/7/2022. S&P 500 Total Return Index, 31/12/1925 – 31/12/2021, and S&P 500 Price Index, 1/1/1928 – 5/7/2022.

Monthly and yearly data use total returns in USD; daily and weekly data use price returns in USD. Currency fluctuations between the dollar and pound may result in higher or lower investment returns.Based on Fisher Investments UK’s review of equity market history, we think equities are forward looking – moving on the gap between what investors think is likely to happen in markets and the actual reality. We think they focus on whether economic fundamentals look likely to keep corporate profits generally better or worse than anticipated over the next 3 – 30 months. Simple logic dictates that this is a function of conditions in the future – not what market performance was over the past day, week, month or year. So, Fisher Investments UK doesn’t suggest extrapolating recent experience forward.

We know downturns like 2022’s first half, both in US and global markets, can increase uncertainty and heighten investors’ urge to avoid equities.vi But we think acting on these impulses more often than not results in investors missing some very good times when markets rebound. So we suggest investors think like equities and look forward, not backward. Investors benefit when they don’t let recent performance cloud their judgement, in our view.

Interested in other topics by Fisher Investments UK? Get our ongoing insights, starting with a copy of 10 Retirement Investment Blunders to Avoid. Follow the latest market news and updates from Fisher Investments UK: