The popularity of special purpose acquisition companies (SPACs) has surged in recent years, but few investors fully understand what they are and how they work. Even fewer grasp whether they are a good fit for their investment goals and long term needs. In this article, we will explore what SPACs are and whether you should consider adding them to your portfolio.

What is a SPAC?

Fisher Investments UK believes you should understand SPAC basics before you decide to invest in one. A SPAC, sometimes known as a “blank-cheque company” is a publicly traded entity formed for the explicit purpose of purchasing privately held companies. SPAC founders – often industry experts – raise cash from investors to fund an acquisition strategy. SPACs have a specific window of time to make a purchase – typically two years.

When a SPAC purchases a private company, it lists shares of that company on public stock exchanges. This is referred to as a “SPAC merger”. Investors in the SPAC become shareholders in the merged company and its shares trade freely in the open market. If the SPAC fails to purchase a private company within the two-year period, it returns the raised cash to the original investors.

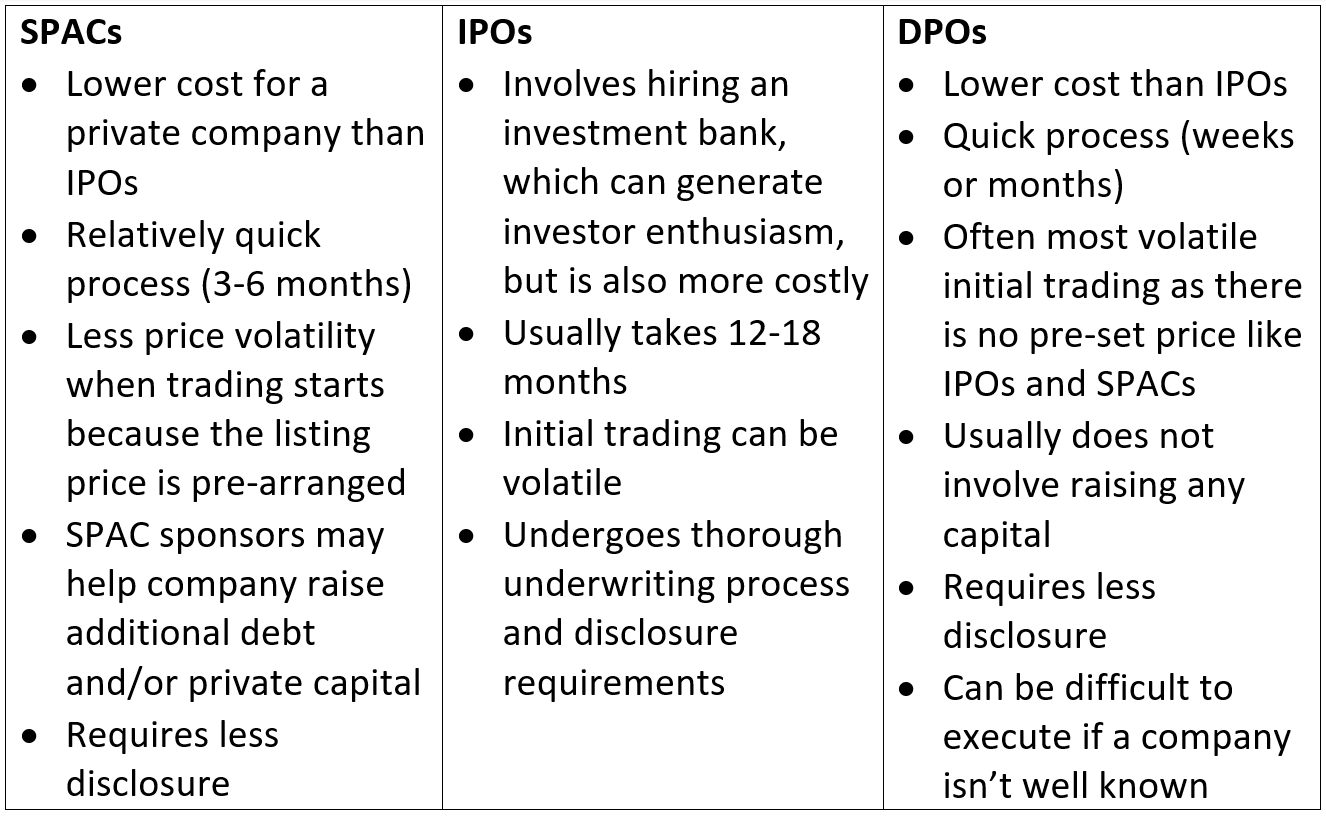

SPACs have been around for a long time, but recent media attention has led many to consider investing in them for the first time. Private companies have historically chosen to access public markets through an initial public offering (IPO) rather than other options like SPACs or direct listings (DPO). SPACs have similarities to IPOs and DPOs, but have some key differences that are worth understanding.

How is a SPAC different from an IPO or a Direct Listing (DPO)?

SPACs, IPO’s and DPO’s are all common ways a private company can become publicly traded, but there are some key differences between each process, including the following:

SPACs may be an efficient method for a company to go public, but have some downsides. It is generally a cheaper and quicker process than traditional IPOs, yet still give a company the chance to raise capital, unlike most DPOs. However, the target company must do extensive work preparing filings and establishing public-company functions (i.e., investor relations) under a tight deadline. A shorter timeline may mean less stringent financial due diligence relative to the scrutiny required in an IPO process. This can be problematic if a company needs to restate its financials, re-value certain assets or pay fines for not properly complying with regulations.

The increased use of SPACs has also brought higher scrutiny by regulators. Just recently, the SEC – the US market regulator – proposed new rules aimed at improving SPAC disclosure requirements and investor protections. These are proposals at this stage, but may alter some of the benefits SPACs have over other options if implemented.

Are SPACs good investments for investors?

Fisher Investments UK believes investors should proceed with caution. Fisher Investments UK’s founder, Executive Chairman and Co-Chief Investment Officer Ken Fisher often says IPO stands for “it’s probably overpriced” – the same logic applies here.

SPACs usually target developing, unprofitable companies with hard-to-predict growth potential and a limited track record. Some are successful, but many are not. According to Nasdaq, roughly half of SPACs from 2019 to 2021 lost value in the 12-month period following a merger, and nearly one-fifth of SPACs experienced losses of greater than 50%. The same data shows nearly one-fifth experienced a gain of greater than 100%, which speaks to the extreme variability investors can expect.i

Some individual investors see SPACs as a way of buying shares at an earlier stage than IPOs – hoping the early advantage will reap rewards. However, SPAC investors don’t know which company the SPAC will merge with, if any at all. Roughly 80% of SPACs target a specific industryii, which may provide insight on the type of company it is seeking, but some are generalists. Regardless, SPAC investors have a high chance of investing in a company they know very little about.

There is also no certainty a SPAC will make an acquisition. The recent spike in interest may create a scarcity of good deals. The more SPACs there are, the greater the competition. Competition puts pressure on SPACs to make a deal and may lead to overpaying, particularly given the finite timeline they have to work with. SPAC sponsors also often have a financial incentive to make a deal, which furthers the risk of improper diligence.

Until a SPAC purchases a company, it is often only as valuable as the cash it has raised. This is why shares in SPACs don’t swing much whilst they are searching for target companies. A SPAC will typically only change materially in value if it makes a successful acquisition or generates enough interest in the SPAC itself. Some SPACs have even enlisted the help of celebrities like Serena Williams, Richard Branson and Jay-Z to raise investor awareness. Investors get their money back if a SPAC fails to make a deal, but having funds tied up for two years for zero return is likely a disappointment for most.

On the surface, SPACs may represent an exciting investment vehicle with upside potential. But as with most investments, high reward usually means high risk. If you aren’t a speculative investor, Fisher Investments UK believes you are better off sticking to a well-diversified global portfolio tailored to your personal financial goals.

Get exclusive stock market knowledge in your Markets Commentary guide as the first of our ongoing insights.

Follow the latest market news and updates from Fisher Investments UK:

Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited has its registered office at: Level 18, One Canada Square, Canary Wharf, London, E14 5AX, United Kingdom.

Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission. Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.

i Source: Nasdaq, as of 1/6/2022. A Record Pace for SPACs in 2021. https://www.nasdaq.com/articles/a-record-pace-for-spacs-in-2021

ii Source: KPMG. January 2021. SPACS versus IPOs. https://advisory.kpmg.us/articles/2021/why-choosing-spac-over-ipo.html