Whilst many investors understand the importance of diversifying their portfolios across multiple sectors and industries, they often neglect the value of country diversification, which can hurt their long-term returns. Concentrating your investments too heavily in only a few equities, sectors or countries may mean missing global investment opportunities and, more importantly, can put your portfolio at significant risk if you are wrong.

Fisher Investments UK believes global diversification can help you avoid country and region concentration risk whilst also potentially expanding your investing opportunities abroad. Here are just a few reasons we believe global diversification is a prudent portfolio management strategy.

Take advantage of more opportunities abroad

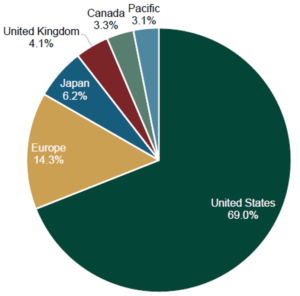

Investing in your home country or region feels more comfortable to many investors than holding foreign equities. But if you’re strictly investing in UK equities, you may be missing out on a lot of opportunities abroad. The UK only represents 4.1% of the MSCI World Index, so only investing in UK equities would mean you do not have exposure to the majority of the developed world equity market.i For example, the US makes up nearly 70% of the MSCI World Index.ii (Figure 1) If you exclude US equities from your portfolio, you would be missing a massive swatch of the global market.

Figure 1 MSCI World Index: Country Allocations

Source: FactSet, as of 12/31/2021. The portfolio above reflects the MSCI World Index as of 12/31/2021. The MSCI World Index measures the performance of selected stocks in 23 developed countries. Pacific includes four developed market countries: Australia, Hong Kong, New Zealand and Singapore. Values may not sum to 100% due to rounding.

Country concentration can also lead to inadvertent sector over- or under-concentration, as some sectors are more heavily represented in certain countries. For example, many large growth-oriented tech and communications services firms are US-based, whilst the UK and Europe have a higher concentration of commodities and value-oriented firms. Concentrating too much in any one region may limit your exposure to equity categories that do well at different points in the market cycle. A UK investor may want exposure to a sector that may not be well represented domestically.

Whilst it may feel comfortable to focus your investments in areas familiar to you, no single investment category, sector or country outperforms for all time – leadership rotates. For example, UK equities performed quite well relative to other developed country markets in 2006 but they have otherwise underperformed from 2008–2020.i If you had based your investing plan around UK stocks following 2006’s relative outperformance, your portfolio may have suffered in the following years. This reinforces the importance of having global exposure in your portfolio to capitalise on rotating country leadership.

Help insulate your portfolio from outsized regional impacts

Investing globally can help dampen the negative effects of regional events or shocks. Everything from political turmoil, war or natural disasters can have dramatic effects on local markets and economies.

Natural disasters like volcanic eruptions, hurricanes, earthquakes and tsunamis can have an outsized impact on the affected country, potentially crippling its infrastructure and local economy. Another potentially impactful event for markets could come in the form of legislation, new regulations or political headwinds. Sometimes lawmakers institute regulatory changes that can negatively influence economies and companies in their local markets.

Global diversification can increase your portfolio’s resiliency to damaging country-specific events.

Global investing can help lower volatility

Long-term investors certainly know that investing in equities can be a rough road sometimes, but by investing globally, you may be able to lower some of that inherent volatility. Whilst leadership between countries can – and often does – change from year to year, those differences tend to even out over long periods.

Historically, all well-constructed, broad equity indexes tend to yield similar returns over long time horizons. Thus, crafting a portfolio of equities from across many different countries can help reduce short-term volatility whilst keeping you on track to reaching your long-term financial objectives.

The broader an index is, the lower the volatility will be over the course of time. A global equity benchmark, like the MSCI World, will probably experience less volatility than a UK equity benchmark over time simply because the broader global approach can help offset the risk of steep dips or spikes from any single sector or region. This can lead to a smoother ride for long-term investors.

Global investing can provide important benefits for investors including greater diversity and opportunity, reducing concentration risk and potentially minimising volatility. Instead of concentrating your investments within just a few countries, your financial health may benefit from thinking globally when it comes to your investment strategy.

Interested in planning for your retirement? Get our ongoing insights, starting with a copy of 7 Secrets of High Net Worth Investors.

Follow the latest market news and updates from Fisher Investments UK:

Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited has its registered office at: Level 18, One Canada Square, Canary Wharf, London, E14 5AX, United Kingdom.

Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission. Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.

i Source: FactSet. The data reflects the MSCI World Index as of 12/31/2021. The MSCI World Index measures the performance of selected stocks in 23 developed countries.

ii Ibid.

iii Source: FactSet, as of 06/04/2021. Gross total returns are presented for MSCI United Kingdom, MSCI World Mid Cap, MSCI World Small Cap, MSCI USA, MSCI EAFE (Europe, Australasia, Far East),

MSCI Emerging Markets, MSCI World Growth, MSCI World Value, and Barclays Aggregate US Bond Indexes from 31/12/2005 – 31/12/2020. All returns are presented in US dollars. Currency fluctuations

between the British pound and US dollar may result in higher or lower investment returns.