The yield curve charts a country’s interest rates across all loan maturities—from short-term rates set by the central bank to long-term government bond rates traded in the marketplace. It is widely thought to be a reliable leading economic indicator. Here we explain why we think the yield curve works and how we interpret today’s yield curves.

In our experience, most investors think upward sloping yield curves—when long-term interest rates exceed short-term rates—are good for equity markets in general. Conversely, investors usually consider inverted yield curves—when short-term interest rates exceed long-term rates—a drag. Indeed, they have historically preceded recessions.i Scholarly research conducted by the likes of Milton Friedman and Wesley C. Mitchell, amongst many others, shows an apparent link between yield curves and economic growth for over a century.

The Yield Curve Matters Because It Influences Banks’ Profitability—and Lending

The yield curve’s record of economic prescience isn’t mere coincidence, in our view. We think it works because the yield curve represents banks’ new loan profitability—and therefore their potential willingness to lend. Lending creates most money supply growth in nations throughout Europe and the developed world, and growing money supply serves as economic fuel. Banks normally back new loans with client deposits or funds borrowed from other banks. The rates they pay for them are generally tied to the short end of the yield curve, typically overnight or three-month rates. Thus, short rates tend to approximate banks’ borrowing costs.

Banks then usually lend at higher rates for longer stretches of time, which the long end of the yield curve generally provides reference rates for. Said another way, banks will typically charge customers a bit more than the prevailing sovereign debt interest rate, with borrowing costs varying according to the customers’ creditworthiness. The difference between long rates and short rates is known as the interest rate spread—a proxy for banks’ potential profit on the next loan made, also known amongst bankers as the “net interest margin.”

Lending Helps Spur Economic Growth

In our view, banks’ loan profitability matters because it incentivises lending and economic activity. The steeper the yield curve—the higher long rates are above short rates—the greater the potential profits on new loans, and the more incentive there is to lend to a wider swath of borrowers. Of course, there are associated credit risks when banks extend loans. A borrower may make payments late. Or not at all, defaulting on the loan.

In general, banks (like investors) take more risk only if there is a suitable reward. When potential profits are high, banks have more incentive to lend to borrowers they might otherwise avoid when the potential return was lower. That can get credit to more parts of the economy that might not be able to access it when the yield curve is flatter, potentially broadening growth. In turn, loan growth can spur more economic activity—spending and investing—from households and businesses, fuelling expansion. Thus, to us, the yield curve isn’t just a forward-looking gauge of economic conditions, but a driver of them.

Inverted Yield Curves Tend to Discourage Lending

The beneficial effects of a positively sloped yield curve tend to reverse when it inverts, making lending potentially unprofitable. If the curve inverts deeply and stays inverted long enough, it can freeze credit and lead to recession. However, an inverted yield curve, on its own, isn’t a timing tool or even an indication that a recession looms, in our view. Because bank loan interest rates don’t usually match government rates exactly—banks’ rates are typically higher—if the yield curve inverts slightly, banks’ actual net interest margins won’t likely close altogether, but simply shrink a little bit. More judicious lending could reduce loan growth, but it wouldn’t necessarily stop it completely.

Besides, more than any individual country’s yield curve, the global yield curve matters more for overall bank lending—and the global economy’s growth prospects—in our view. The developed world’s banking system is dominated by big multinational banks, which can borrow internationally where most favourable, hedge the currency risk (meaning, use so-called derivatives and other tools to insure against currency fluctuations) and lend where profitable. Today, this might mean borrowing in the eurozone, Sweden or Japan for close to zero and lending in Britain, America and even southern Europe at higher rates—a key reason we don’t think the US yield curve’s brief late-March inversion was crippling for global markets.ii

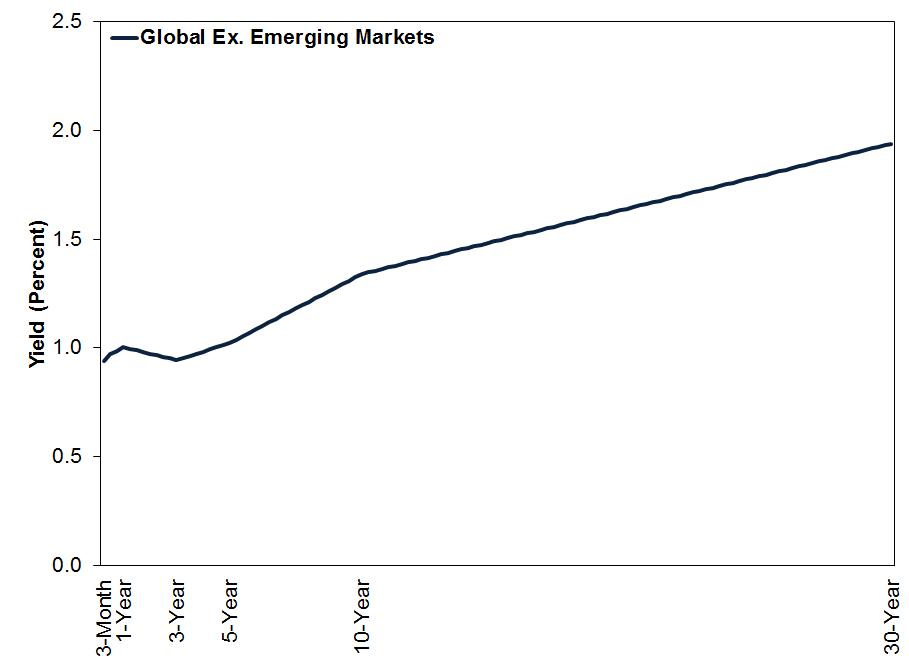

The Global Yield Curve Remains Positively Sloped

Exhibit 1 depicts a composite of developed markets’ yield curves, weighted by gross domestic product (GDP, a government-produced estimate of national economic output), which we think better captures banks’ potential lending profitability. As of April, the developed world yield curve was positively sloped, which we think should continue helping to propel loan growth. With financial conditions appearing favourable, eurozone lending has risen this year and broad money supply has followed suit—good indications credit is circulating where needed, supporting further economic expansion, in our view.iii

Exhibit 1: Global Developed Market GDP-Weighted Yield Curve

Source: FactSet, as of 8/4/2019. Weighted-average of interest rates from Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the UK and the US, with each country’s contribution weighted according to its GDP in 2017.

Interested in other topics by Fisher Investments UK? Download your free copy of Markets Commentary and receive ongoing insights.

Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited has its registered office at: 2nd Floor, 6-10 Whitfield Street, London, W1T 2RE, United Kingdom.

Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission. Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.

i“Economic Forecasts with the Yield Curve,” Michael D. Bauer and Thomas M. Mertens, Federal Reserve Bank of San Francisco, 5/3/2018.

iiSource: Federal Reserve Bank of St. Louis, as of 11/4/2019. The 10-year minus 3-month US Treasury yield curve inverted 22/3/2019 – 28/3/2019.

iiiSource: ECB, as of 28/3/2019. Monetary Developments in the Euro Area, February 2019.