By Fisher Investments UK

When deciding where to invest, one of the critical questions we think investors face is whether to own international shares. “Buy what you know” is a mantra we hear often, and many investors know their home country best. Yet in our view, investing in your home country alone may not be the best approach—even in a country as deep and strong as the UK. Whilst the UK economy is well diversified, its equity market’s sector makeup veers considerably from the global market, which we believe can impede diversification. The UK boasts many competitive multinationals, but they tend to cluster in a few sectors. This can benefit UK investors’ returns when those sectors do well, but that isn’t always the case. We believe investors who look globally have more opportunities to diversify.

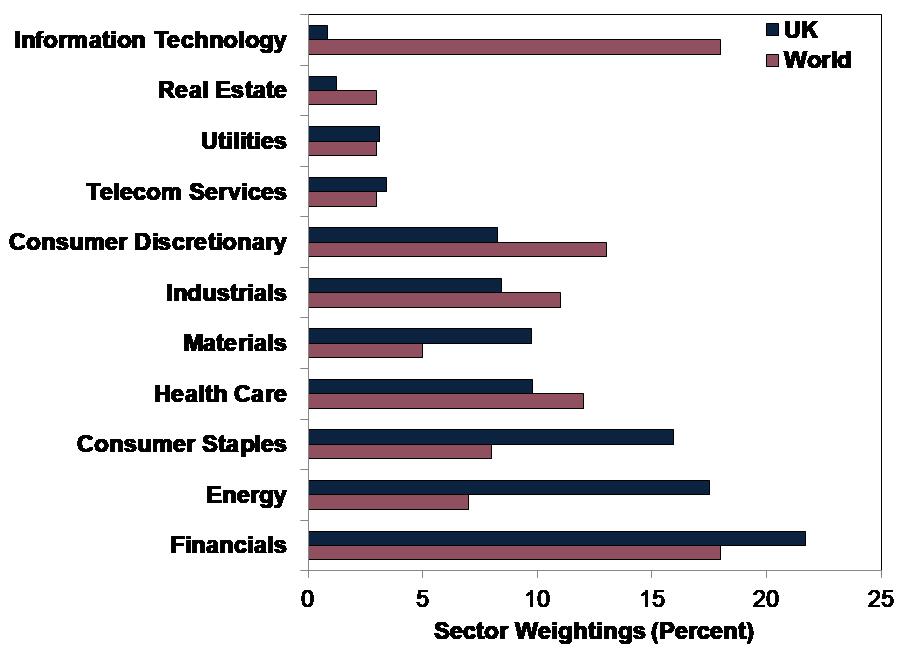

As Exhibit 1 shows, some UK sector weights—calculated as the percentage of the index’s market capitalisation (total market value of all companies) represented by each sector—veer markedly from the developed world as a whole. The MSCI UK Index’s 22% Financials sector weight may be only modestly larger than MSCI World’s 18% Financials weighting. However, the UK’s 18% Energy and 10% Materials exposures far outweigh the MSCI World’s 7% and 5%, respectively. Combined, the UK’s weighting in commodity-oriented sectors is more than double the MSCI World’s, thus making UK returns more sensitive to commodity prices, since commodity prices heavily influence corporate earnings in these sectors. This is a large reason why the MSCI UK Index fell -5.8% when oil prices crashed from 30/6/2014 – 31/1/2016, whilst MSCI World gained 11.0%.[i] UK Consumer Staples’ 16% weight, which is double the MSCI World’s 8%, highlights another heavy concentration. Yet there are also big blind spots: The Information Technology sector is 18% of the MSCI World Index but 1% of the MSCI UK. We believe heavy sector concentrations in Financials, Energy, Materials and Consumer Staples—and a dearth of Tech exposure—leave UK-only investors vulnerable to sector-specific risks they could reduce by investing globally.

Exhibit 1: MSCI UK and World Index Sector Weights

Source: FactSet, as of 23/5/2018. Market capitalisation of each sector divided by market capitalisation of the relevant index, displayed as a percentage.

For example, consider the Financials sector. Large multinational UK banks have sizable global footprints, but British lending institutions sometimes face their own unique challenges. For example, mortgage loans carrying variable interest rates represent a large share of UK mortgage lending, whilst most US mortgages are carry fixed interest rates. As a result, UK Financials’ earnings can be more sensitive to volatility in long-term interest rates. We believe having global exposure within the Financials sector can help mitigate such country-specific risks.

Global diversification can also help balance sector exposure. In addition to reducing the influence of commodity prices relative to a UK-only portfolio, it can also address the high Consumer Staples concentration. Whilst the sector has performed very well at times, leaderships shifts often. According to our research and analysis of historical equity market data, Consumer Staples has historically benefitted less from strong global upturns than other sectors that are more sensitive to the economy’s swings. Diversifying globally can also help UK investors overcome the country’s biggest blind spot: a near-total lack of Technology firms. After some private equity acquisitions and foreign buyouts, it is hard for UK-only investors to get meaningful exposure to publicly traded Tech companies, limiting their ability to capitalise on global growth in mobile technologies and cloud computing.

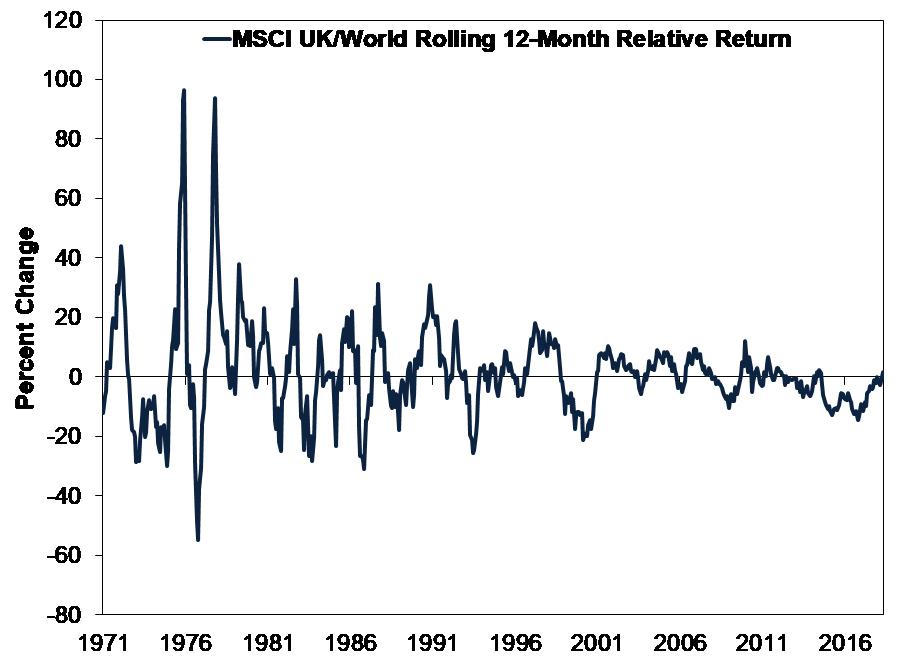

There are times when the UK outperforms—sometimes by a lot!—and you would be glad not owning foreign shares. But history also shows long stretches where that isn’t the case. (Exhibit 2) This is when a diversified global portfolio’s benefits are most visible, but we believe the benefits are evergreen. It allows you to more easily add exposures that look attractive and lower exposures to areas relatively less so. Global includes the UK. When drivers favour the UK a global investor can add to their UK weighting, tailoring their exposures to the sectors best positioned for those drivers. That doesn’t mean a globally diversified portfolio overweight the UK will always outperform a UK-only portfolio, but over the longer term as different styles, sectors and countries go into and out of favour, we believe diversifying globally can help expand your opportunity set and allow you to better manage risk.

Exhibit 2: MSCI UK Relative to World Returns

Source: FactSet, as of 23/5/2018. 12-month rolling MSCI UK with gross dividends in GBP relative to World Index with net dividends in GBP, January 1972 – April 2018. The relative return is calculated by subtracting the MSCI World trailing 12-month percent change from the MSCI UK trailing 12-month percent change for every month. Thus, when the line is above zero, the MSCI UK Index outperformed the MSCI World Index over the past 12 months, and it underperformed when the line is below zero. Past performance neither guarantees nor reliably indicates future performance.

Investing in familiar names may seem more comfortable, but we believe home-country bias is an error. The UK has always been globally focused—flourished from it. UK investors should benefit from being outwardly oriented, too, in our view.

Follow the latest market news and updates from Fisher Investments UK:

On Facebook

On Twitter

On LinkedIn